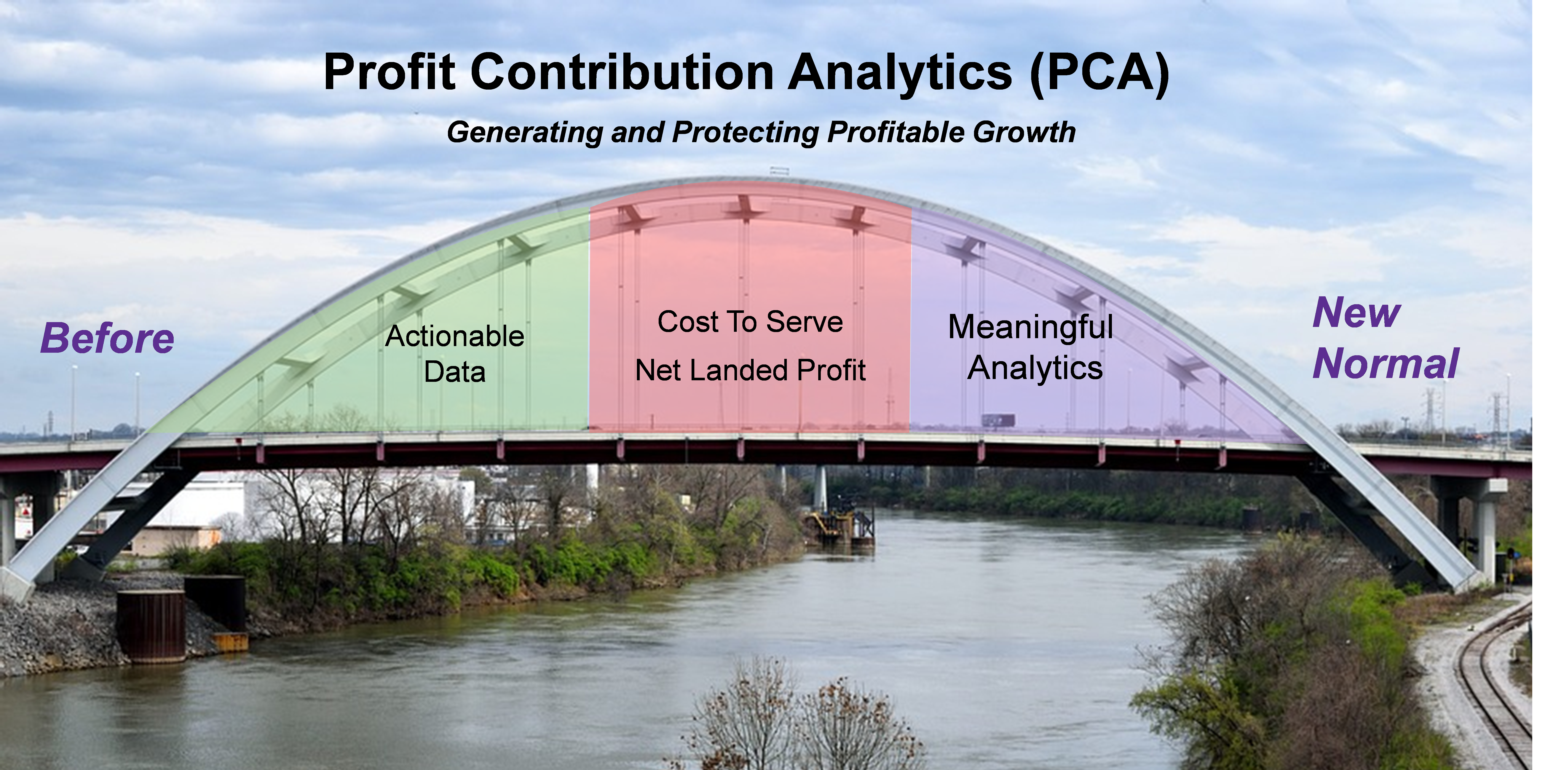

“Using siloed data is the Achilles heal for identifying actionable insights to reduce costs and protect profit margins. With today’s extreme inflationary pressures coupled with limited resources and product shortages, it is critical to have cross functional participation in creating “one version of the truth” to stop information disconnects and to rapidly drive actionable decisions."

-A Supply Chain Industry Forum

In order for any analytical solution to be meaningful, the issue of data quality needs to be addressed. The goal is to demystify the whole notion of harnessing Big Data analytics from being a seemingly impossible, daunting task to one of creating an invaluable asset that drives significant financial performance improvements.

Case Study

While I was the President of CAPS Logistics for over 8 years, the company serviced over 16% of the Fortune 500 in various forms of supply chain decision support applications. These efforts spanned the globe from supporting the expansion efforts of a worldwide soft drink company, to the redesign of supply chain networks for multiple CPG and specialty manufacturing companies and providing different transportation solutions to one of the largest companies in the waste management industry. The technology was proven, the people were bright and the focus was to provide the best solutions possible. Unfortunately, in most cases, the implementation of these carefully engineered solutions was either slowed down or even put on hold. Why? Other departments would offer objections often citing concerns about the “quality” of data used for the analysis. Typically, the nail in the coffin would be that if they would offer that their data concerns were correct, the integrity of the solution could cause the company to miss its revenue targets. Sound familiar? The end result was that the company did not attain the competitive advantage that was possible.

Let’s take this lesson to the world we live in today

In a world of exponentially growing data associated with the operation of your enterprise the problem sited above had two issues. The “quality” concern which will be addressed in a future posting on data governance. The second issue was not having cross-functional consensus. In the projects mentioned above, efforts were made to involve other departments at every stage of the project but gaining supply chain efficiencies were not their highest priority. Therefore, these other functional groups had no real buy-in in the work effort.

If you believe that Big Data has the opportunity to drive significantly recurring financial improvements, then the table stakes are even higher with regard to early organizational buy-in. Buy-in with regard to getting everyone on the same page on how to repurpose and use Big Data to empower multiple forms of new analytical and strategy development capabilities. I am guessing that many of you are saying “yea, right for our company; this would be comparable to building Noah’s Ark.” You may be right but it is a challenge that deserves careful consideration as offered by the following quote by Benjamin Franklin: