Thought the speakers did a great job looking past the hype from two really popular topics – #Tariffs and #AI , and instead focusing on practical applications.

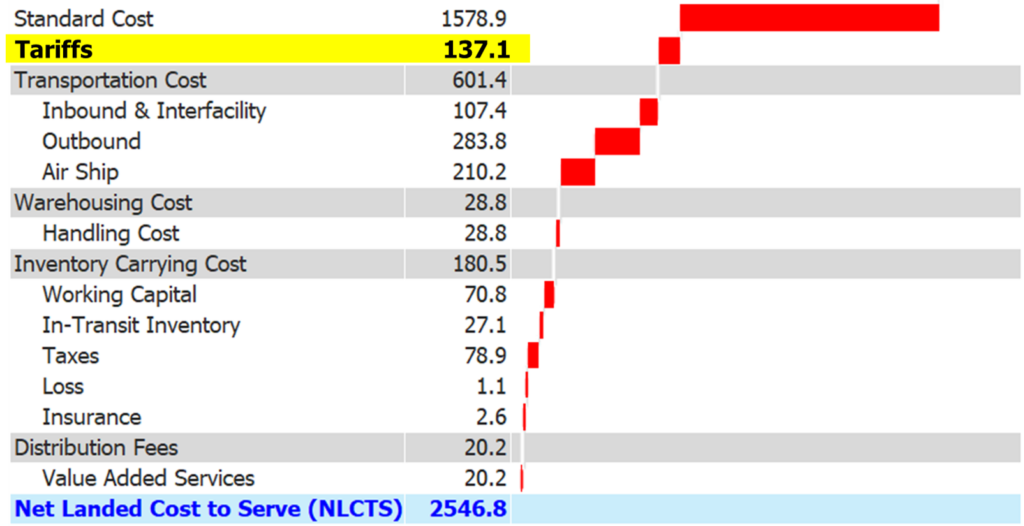

Richard Sharpe reminded us that tariffs are just one cost variable that go into your Net Landed Cost equation.

-LinkedIn post from Matt Labagh

Strategically Practical Tariff Mitigation Strategies

At the first Annual Conference for the San Diego Association for Supply Chain Management (ASCM) Conference, Richard Sharpe delivered the Keynote presentation to a standing room only event. The highly interactive discussion offered recommendations for developing informed tariff mitigation strategies. Strategies empowered by accurate, specific and actionable product, customer and supplier Cost to Serve and Profit performance insights. Strategies that out perform general price increases.

Examples were offered for the following short term, intermediate and long-term strategies:

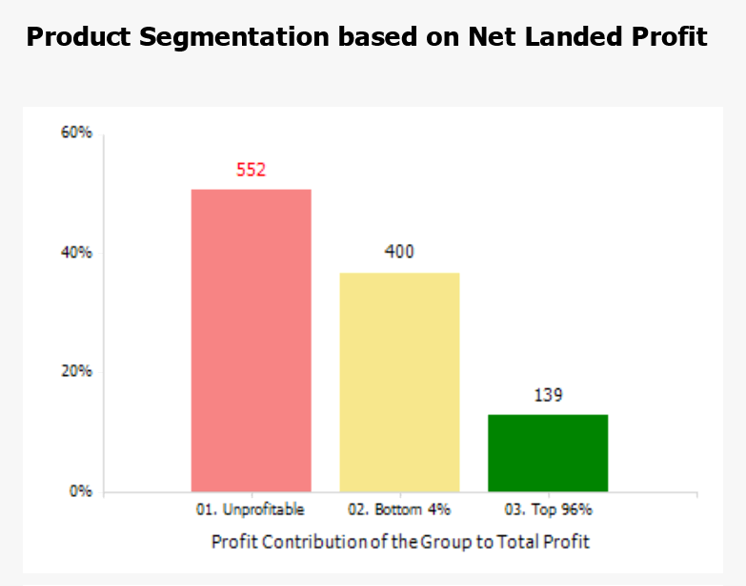

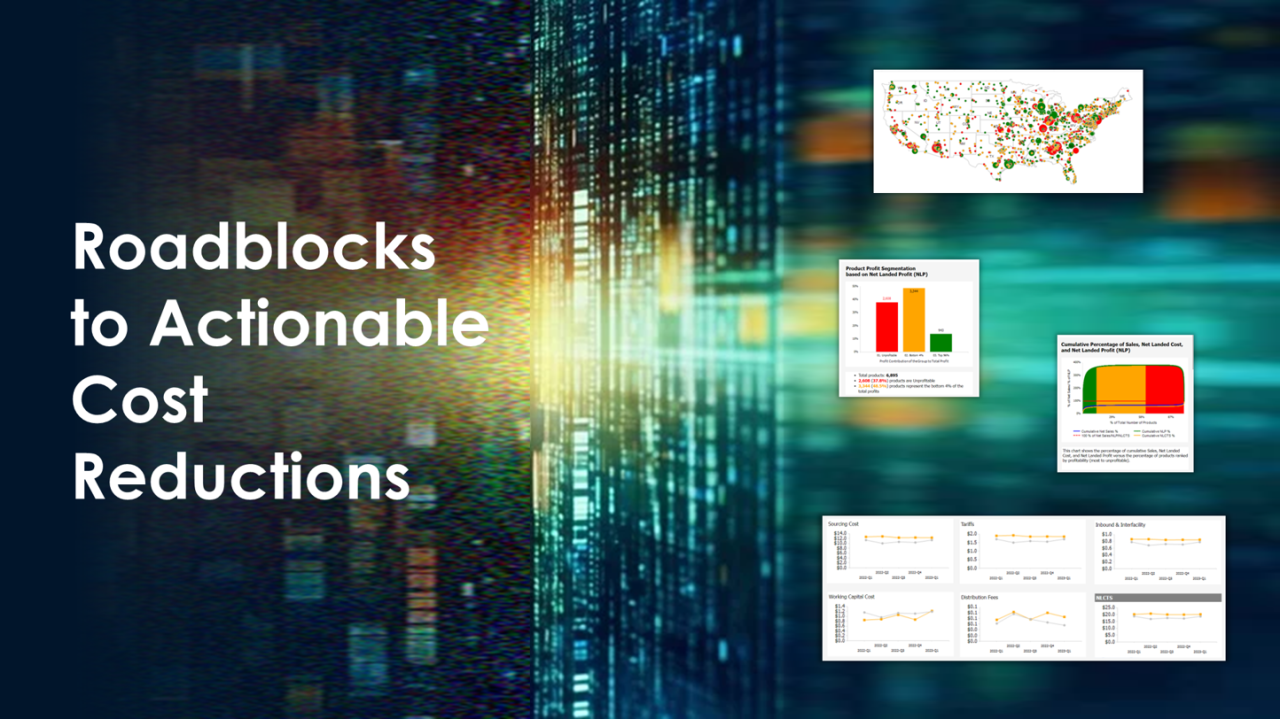

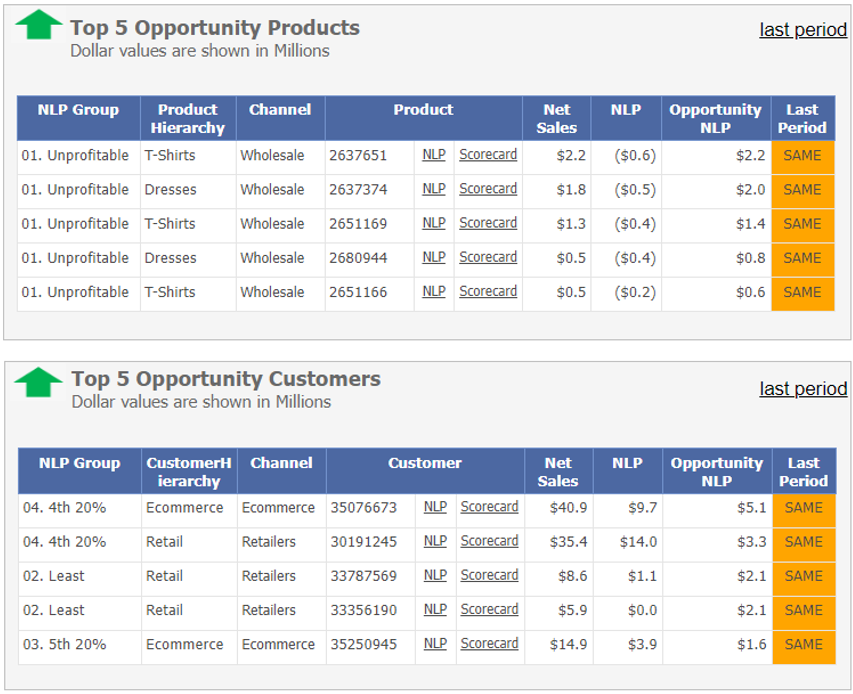

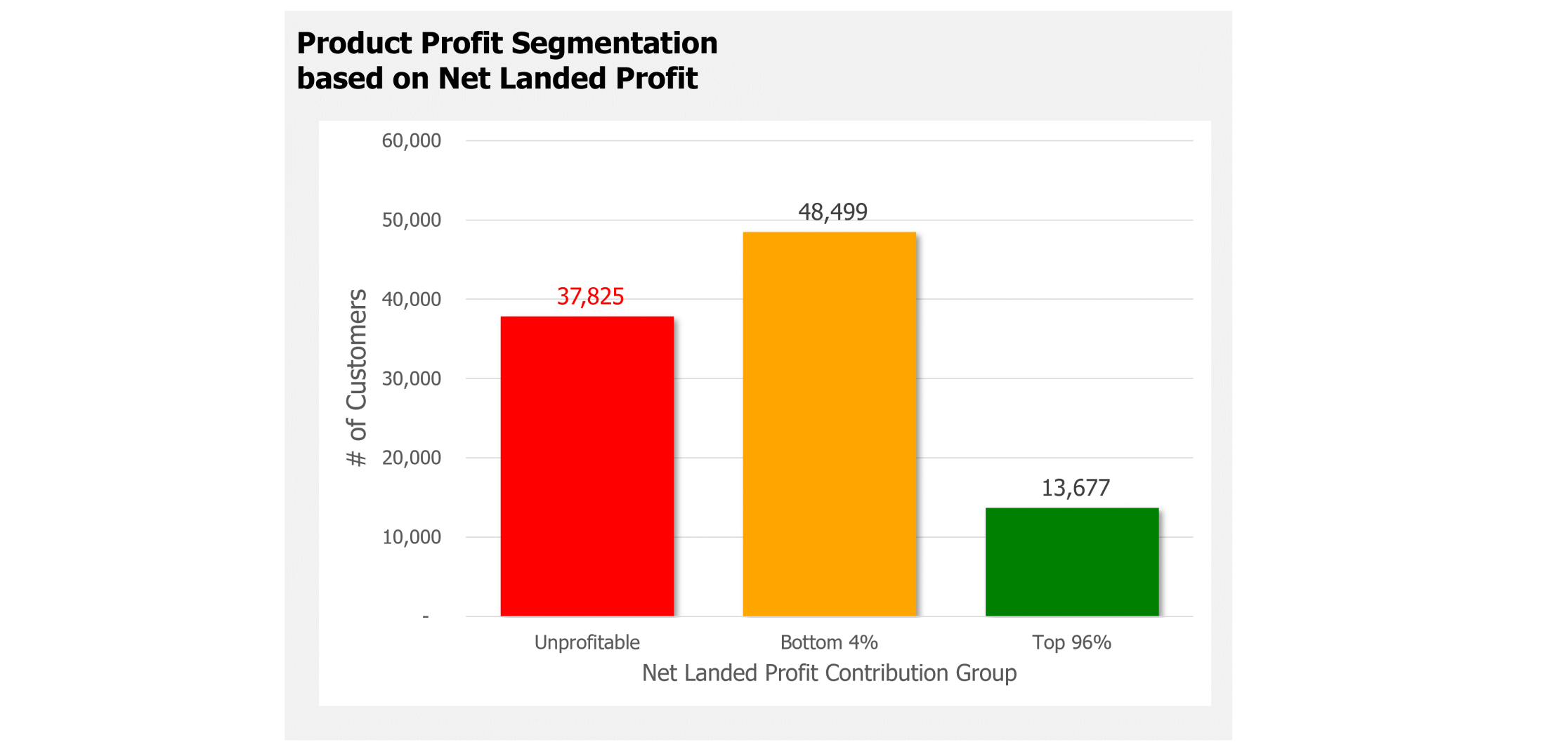

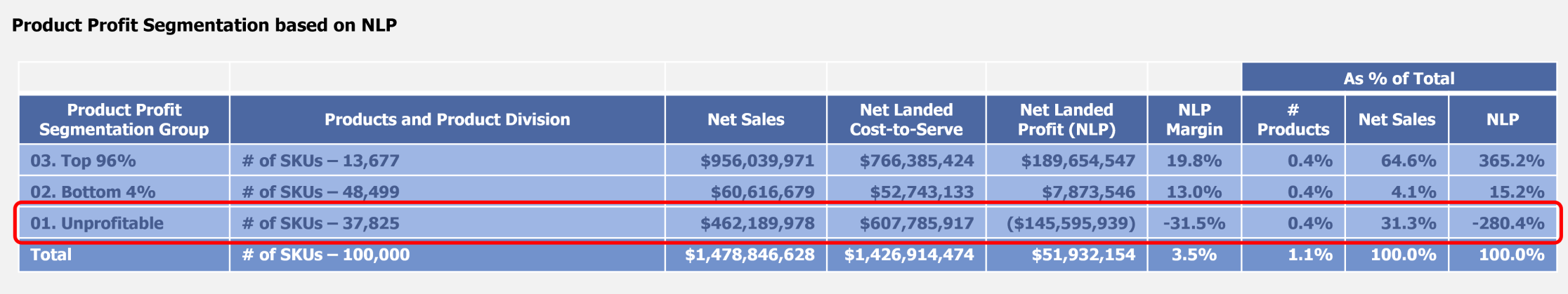

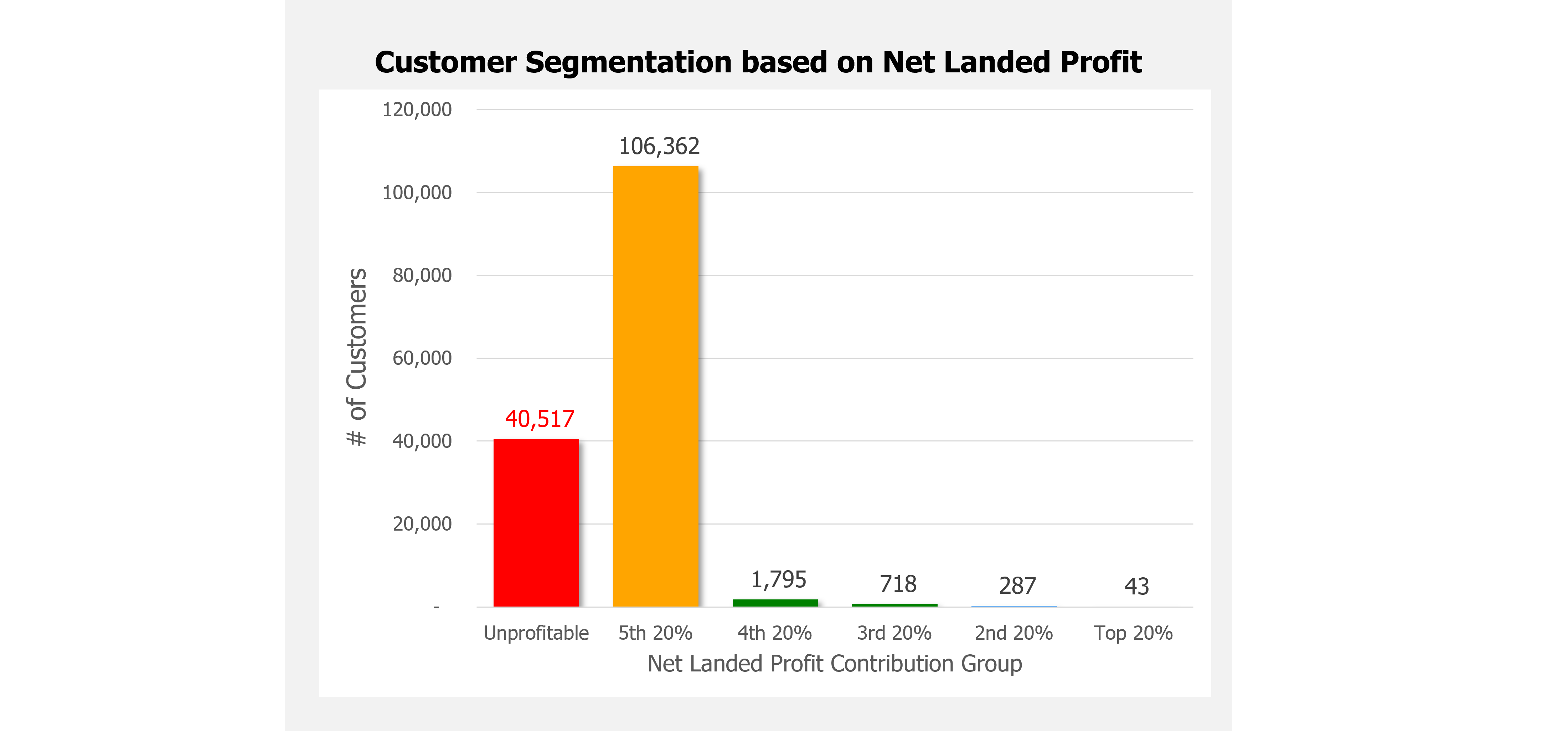

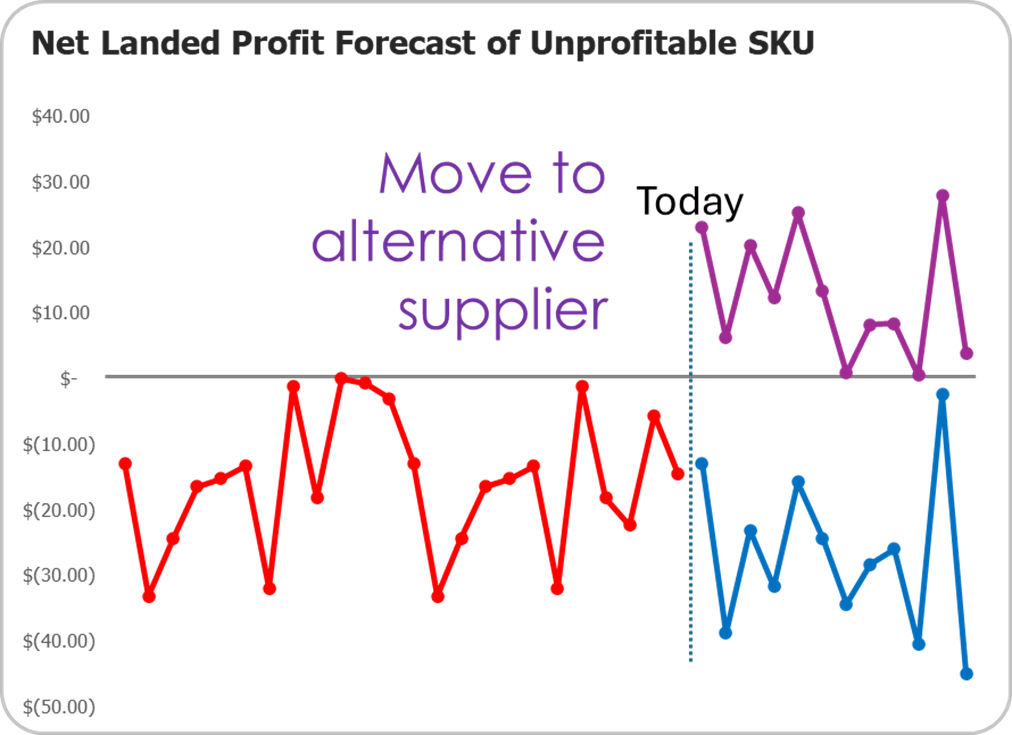

Short Term (6 weeks) – because tariffs are only one line item of cost, pinpointing specific revenue and cost improvement opportunities for unprofitable Products can more than offset any increase in tariffs while improving the performance of unprofitable Products.

Intermediate (6 months) – benchmarking cost and profit performance for Customer and Product categories can identify substitutable Products that have a better profit profile even with increased tariffs.

Long Term (2 years) – understanding the profit contributions for specific Products sourced from each Supplier can help prioritize Procurement resources on the Suppliers and Products that matter the most when developing tariff mitigating strategies.

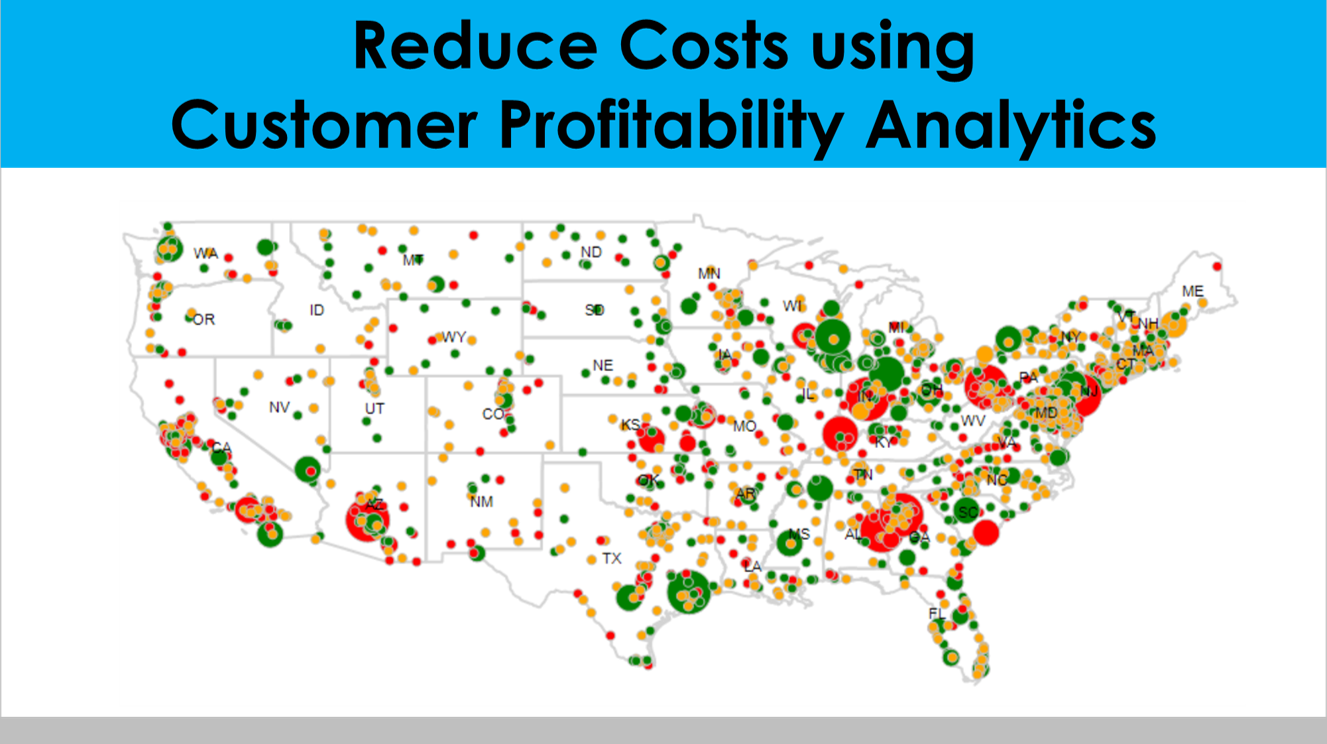

Competitive Insights is an industry recognized leader in providing trusted AI solutions. Solutions that offer visibility on cost and profit performance specific to Products, Customers, Channels, Inventory, Pricing and the impact of tariff strategies.

This visibility provides fact-based insights on how you can mitigate costs and identify the best options to protect margins and profitable performance including tariff mitigation strategies.

We would love to hear your thoughts and comments. Please feel free to reach me directly at rsharpe@ci-advantage.com or visit our website at www.ci-advantage.com.

All the best,

Richard Sharpe

CEO – Competitive Insights