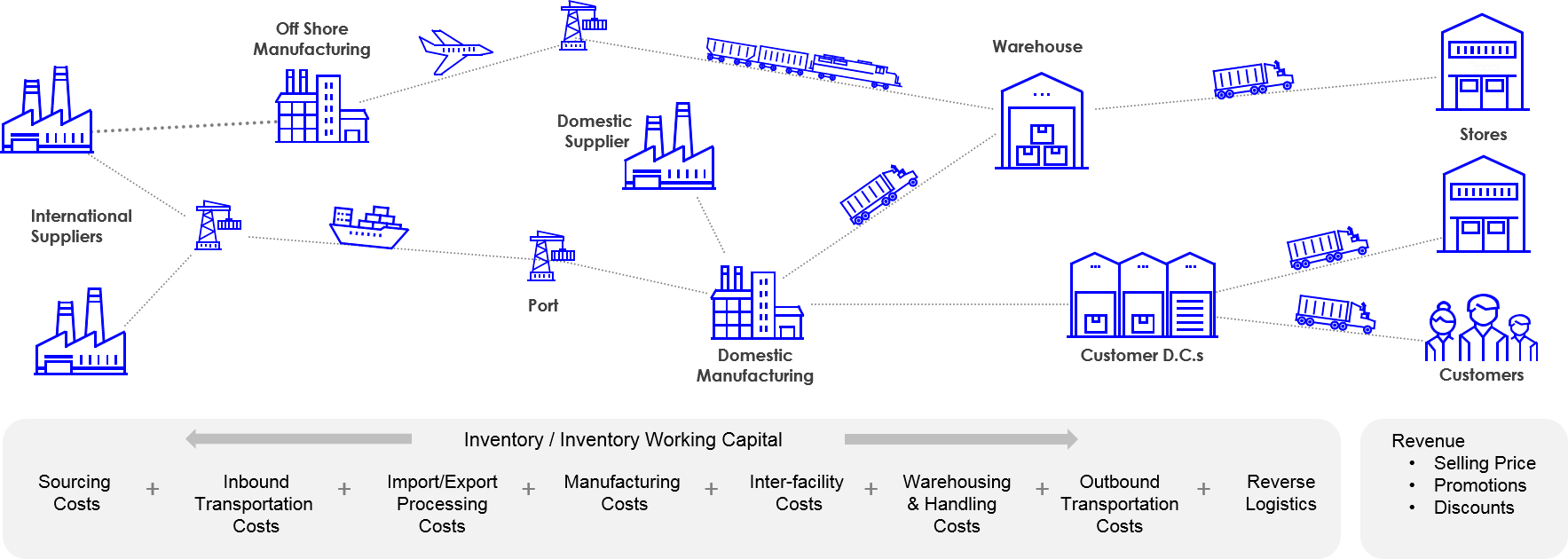

“The cost of NOT knowing your true total cost of transportation impacts profitability, inventory cost, scalability, valuation, EBITDA and more"

Tom Valentine - Valentine Solutions, LLC

With constant supply chain disruptions and inflationary costs increases, we all are feeling the stress and frustration of managing “The Now”. Not having the time and resources to plan, implement, check and adjust for the future state is truly costing us all.

Supply Chain professionals everywhere are doing their best, yet every day we read and hear from the Boardroom to the Docks:

“The problems and profitability challenges we are experiencing are ALL due to our Supply Chain issues”

What is not often understood is that many of these issues are outside the control of the supply chain operation. Demand increases, labor challenges, increases in pay requirements, equipment availability, raw material shortages, lack of capacity, increased lead times and driver shortages all contribute to these challenges. Challenges that are causing increasing costs, complexity and capacity and therefore end to end supply chain bottlenecks. The planning and execution of shipping goods from origin to final destination has a HUGE impact on your customers’ experience and your true profitability.

This problem is not going to go away any time soon. Companies are aggressively re-evaluating the entire structure of their supply chain operations. Unfortunately, many approaches being explored are relying on the “traditional” supply chain operating principle:

“Work to satisfy ALL customer demands, on time while minimizing costs!”

That mindset has to change if we are to eliminate constraints, reduce stress, frustration and maintain or even increase profitability. For most companies, a small number of customers and products drive the majority of the operating profit, while many customers and products (SKU’s) drain those very same profits directly from the bottom line. So, the question becomes:

“How do we know what time and resources are being assigned to customer shipments that are actually significantly reducing our profit?”

A sustainable solution (not so traditional for companies) is to use profit performance to address capacity, complexity and cost issues. Using your transactional data for deep dive profit analytics provides true visibility to answer the above question while empowering your team to focus on customers and products that provide the biggest bang for the buck.

- The Coca-Cola Company eliminated over 200 SKU’s they traditionally produced including TAB!

- UPS knows by each customer and shipment their profitability level. Do you?

To help you get started here is a step by step approach for the critical actions in assigning resources for customer and products based on their profit contributions:

- Recognize that your supply chain resources should be prioritized based on profit performance and competitive advantage and ensure there is cross-functional and senior level buy-in.

- Adopt a Cost-to-Serve approach to truly understand the costs and profits associated with servicing not just select customers, but ALL customers.

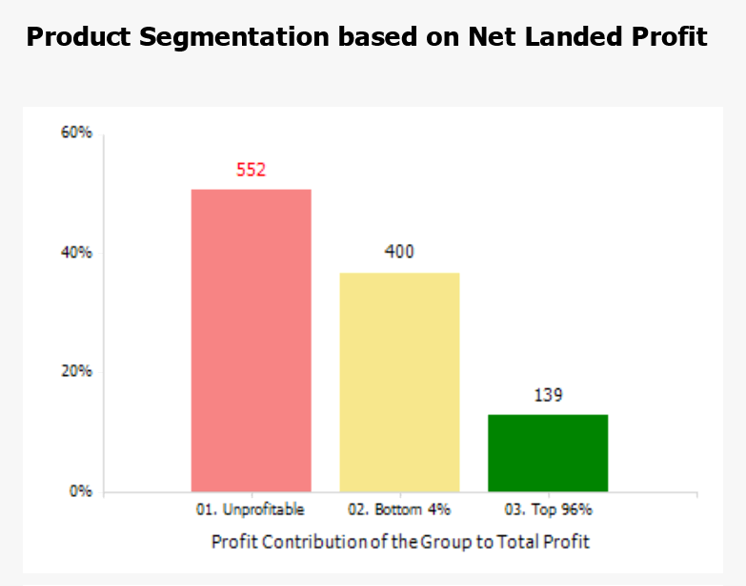

- Build a profit performance profile for ALL customers and ALL products by segmenting by performance. The results will help drive actionable insights and organizational support! This is what it can look like:

- Critical Shipment Priority: the customers and products that deliver 96% of your profit

- Subsequent Shipment Priority: that deliver customers and products equal 4% of your profit

- Delayed/No Shipment Priority: unprofitable customers buying unprofitable products (BTW-you won’t find these using standard cost accounting!)

- Continue to build cross-functional buy-in on the Shipment Priority Plan using profit analytics as the “One True Version of the Truth” and ensure continued Executive support.

- Execute the Plan and measure the profit protected on an ongoing basis.