Thriving After COVID – Essential Step 3 - Profit Analytics Drives Coke’s Bold Strategy

On August 22, one of the world’s most iconic brands announced that they will reduce the number of brands in their portfolio by 50%. James Quincey, CEO of The Coca-Cola Company, stated in The Wall Street Journal;

"now is the time for Coca-Cola to cull the portfolio of the many small, less profitable, resource-depleting brands"

It is hard to find a company that has not experienced a significant impact from COVID and the Coca-Cola Company is no different requiring strategic action. Coke announced cost cutting measures such as a workforce reduction of 4,000 employees. But Coke also is taking decisive action by cutting half of its product brands.

“All told, the 200 brands slated to be discontinued account for only about 1% of the company’s profits. They consume too much attention and resources, Coke leaders said.”

Atlanta Journal Constitution October 22, 2020

Are you prepared to walk into your Board Room and recommend cutting half of your products based on their profit contributions?

Roadblock 3: Moving Beyond Traditional Product Portfolio Decisions

Portfolio decisions are based on a number of key criteria. Often the focus is to maintain a competitive advantage by anticipating customer demands that drive increasing revenues. This reminds me of a story for an Apparel company.

The head of the supply chain was dealing with a significant increase in SKU proliferation. Apparel supply chains are very similar to many industries in that they are very complex. They operate on a global footprint that involves multiple tiers of suppliers and service providers. He needed to find a way to reduce the cost and complexity of his operation.

His question was “can we measure the profit contributions below the SKU level to the actual performance by the article’s color?” Fortunately, his organization had trusted, actionable data. They had built accurate, detailed Revenue and Cost to Serve information, down to the color level. At the next product planning meeting he came armed with meaningful profit analytical insights and stated;

“We have never made one dollar of profit on any item that we have sold across all categories with the color fuchsia. Why are we including this (fuchsia colored products) in our next set of product releases?”

Executive Vice President – Supply Chain Operations

Continuing to measure SKU performance, his company was able to cut inventory, increase profitability, release capital for more productive uses and reduced operational complexity.

Meaningful Analytics To Drive Smart Portfolio Decisions

Summary

COVID has served as a wake-up call. Shareholders and stakeholders are going to mandate that company executives can measurably demonstrate they are adding resiliency in their ability to generate and protect shareholder value.

Here are the key takeaways:

- Standard accounting measurements do not provide the detailed visibility needed when measuring product and customer performance.

- For most companies, the 80-20 Rule overstates the specific products and customers that provide the vast majority of profit contributions.

- Having fact based, trusted profit analytics MUST be a key catalyst for establishing portfolio strategies for corporate growth and profitable performance.

- Potentially redirecting resources away from marginal and unprofitable products and customers increases the return on operating investments in addition to reducing complexity.

- Global supply chains must be managed by having visibility to changing profit opportunities and potentially disruptive events. This visibility must be available and used on an ongoing basis.

Empowering the organization with repeatable, fact-based profit contribution analytics provides the foundation for thriving and not just surviving in stable and disruptive times.

The Coca-Cola Company recognized this. They acted in a very bold and proactive manner.

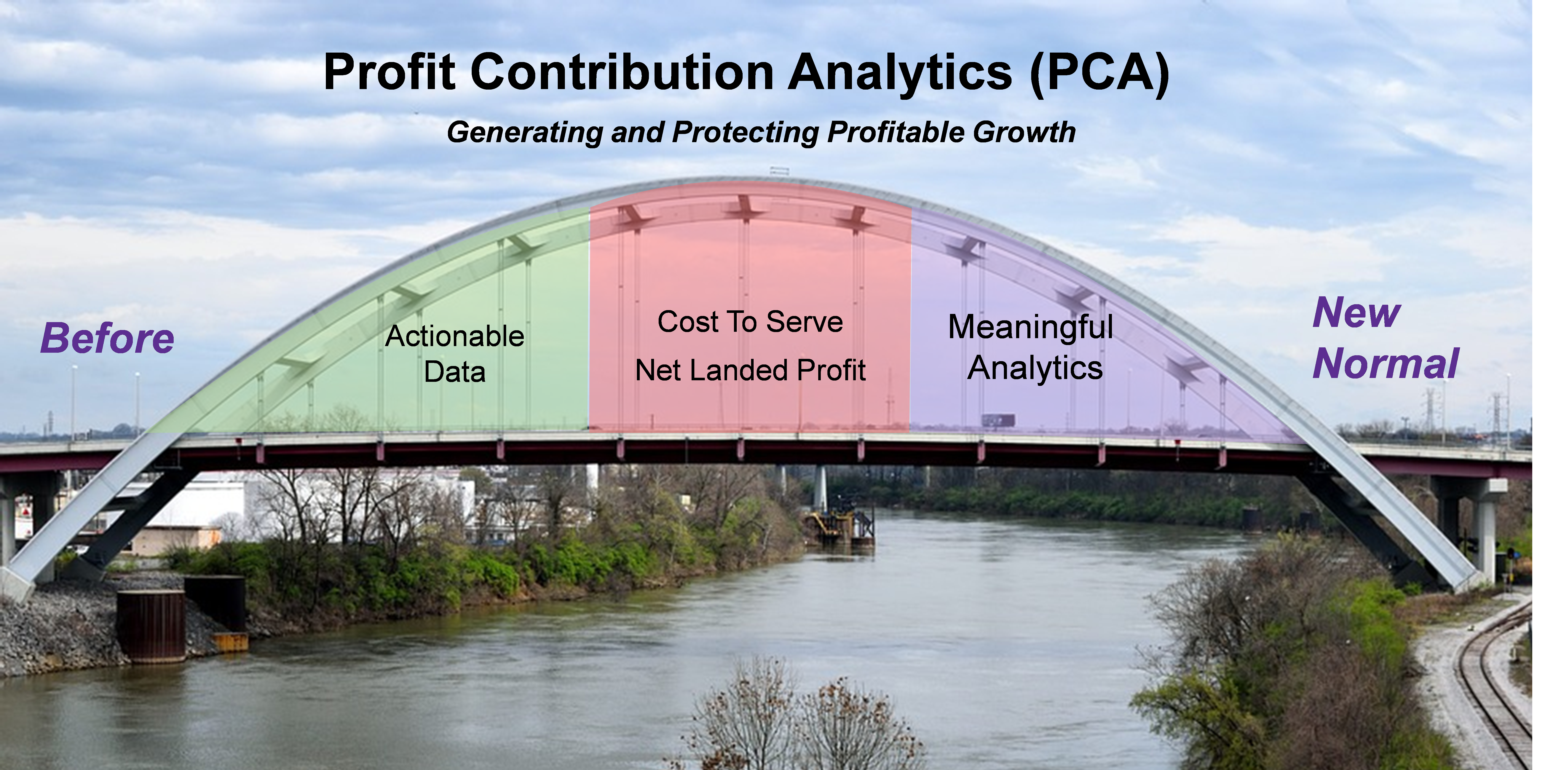

Will you have the courage to push to focus on only products that drive sustainable profits to guide your company to thrive and not just survive? Do you have the information you need to back it up? Are you ready to cross the bridge?

Please comment on this posting or email me at rsharpe@ci-advantage.com .

All the best,

Richard Sharpe

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.