One of the world’s most iconic brands announced they would reduce the number of brands in their portfolio by 50%. James Quincey, CEO of The Coca-Cola Company, stated in The Wall Street Journal:

"Now is the time for Coca-Cola to cull the portfolio of the many small, less profitable, resource-depleting brands"

“All told, the 200 brands slated to be discontinued account for only about 1% of the company’s profits. They consume too much attention and resources.”

Atlanta Journal Constitution October 22, 2020

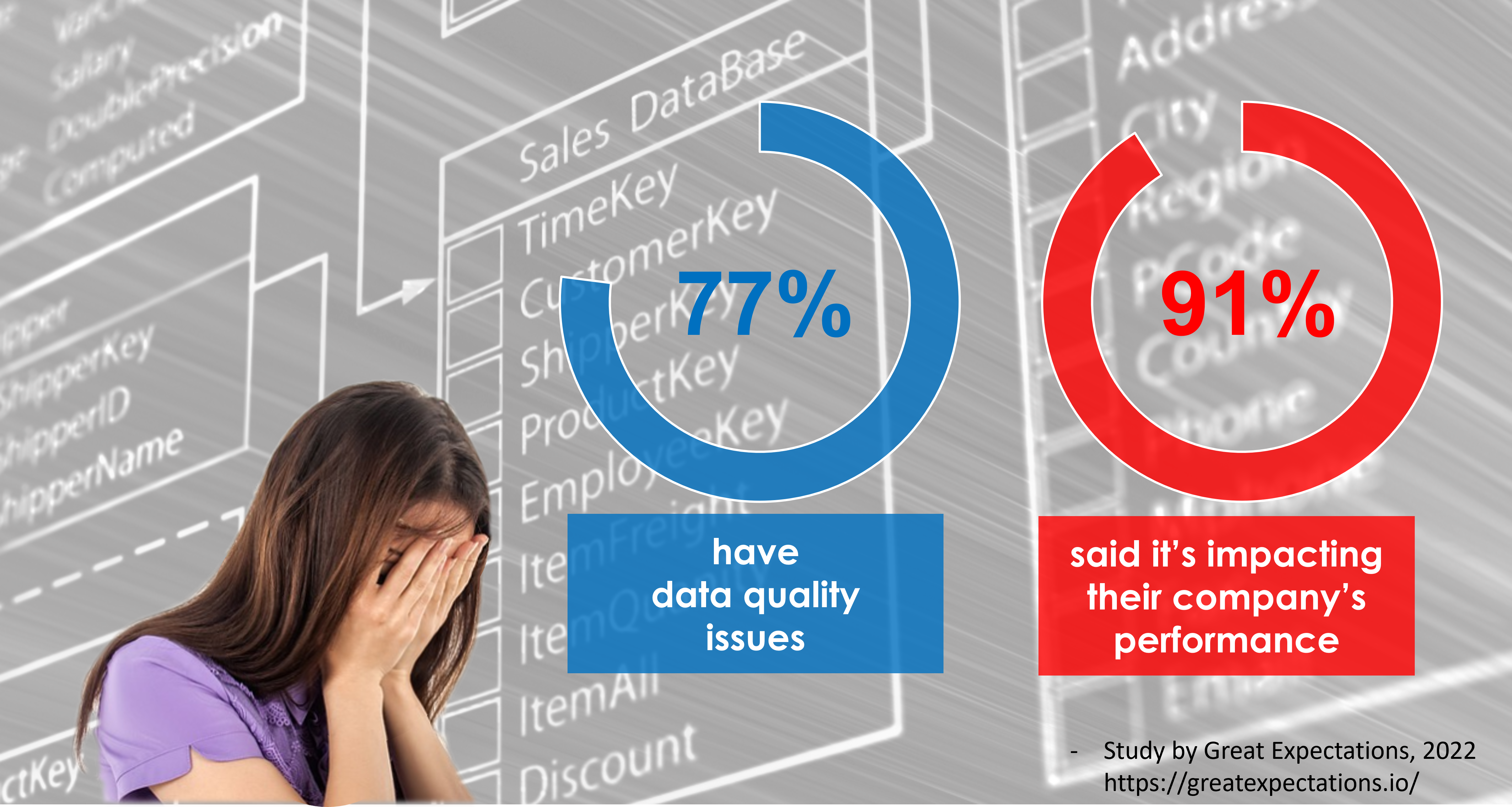

With growing inflationary pressures, companies are pursuing aggressive strategies to reduce costs and operating complexity while still delivering expected profit contributions and shareholder value.

One prime area of focus is Portfolio Management.

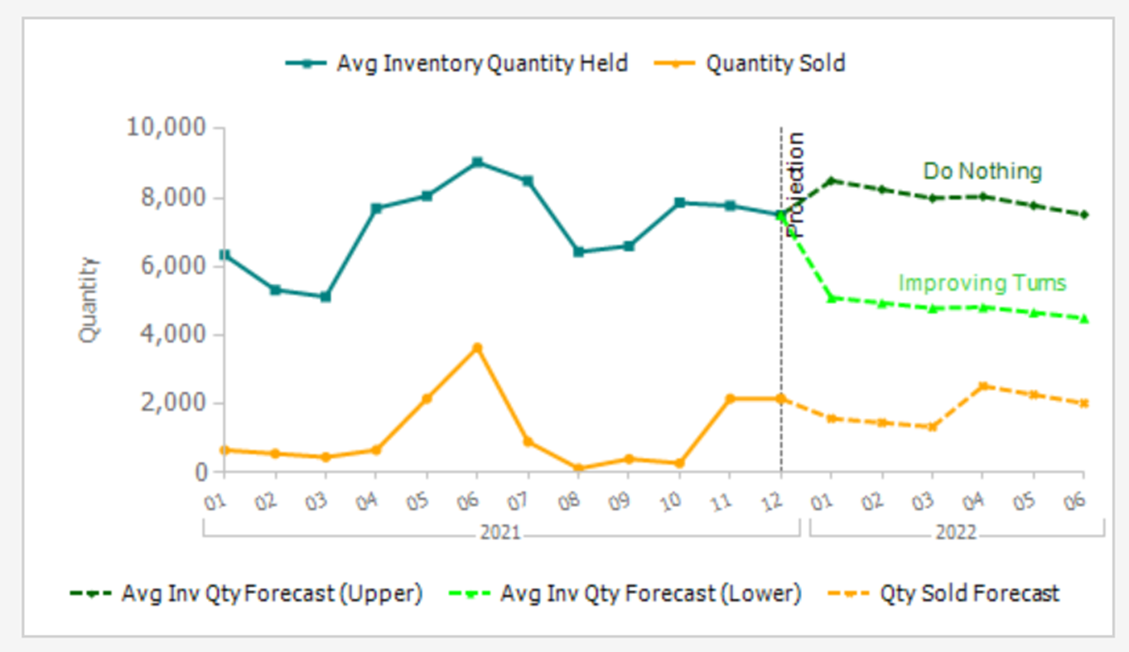

Progressive companies are taking a proactive approach to reducing cost and operational complexity by performing a rigorous review of their product portfolio:

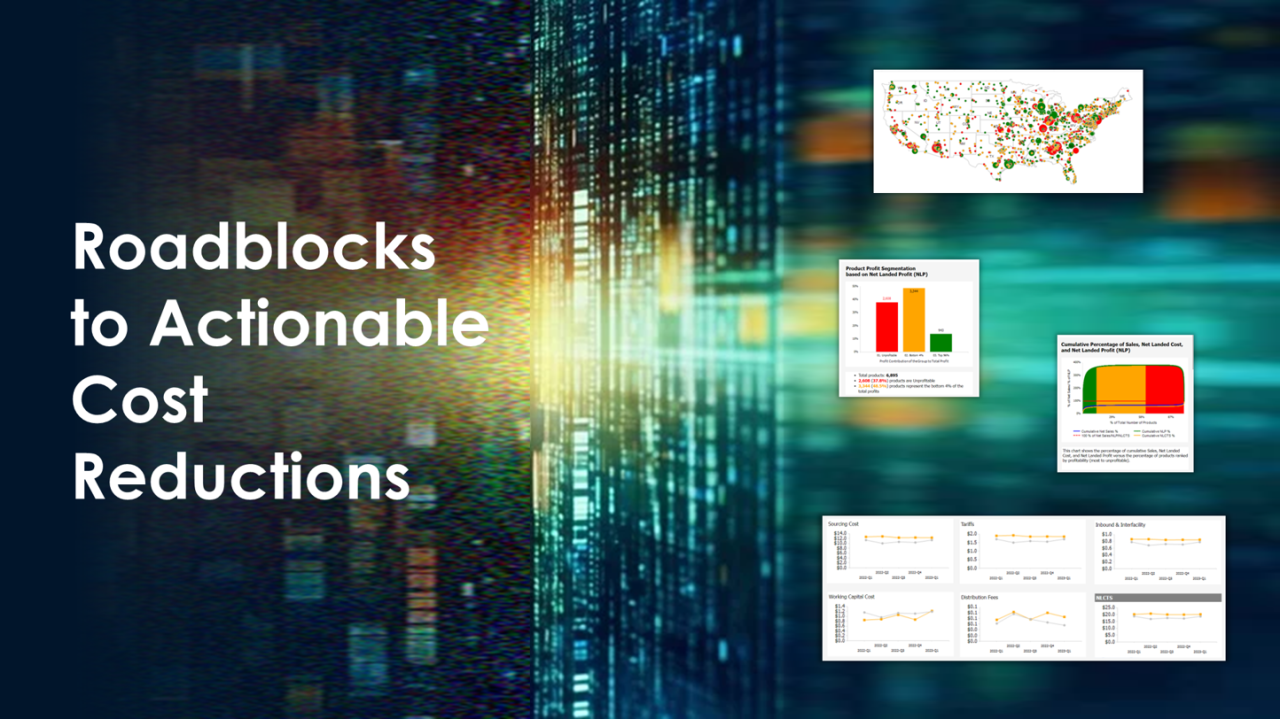

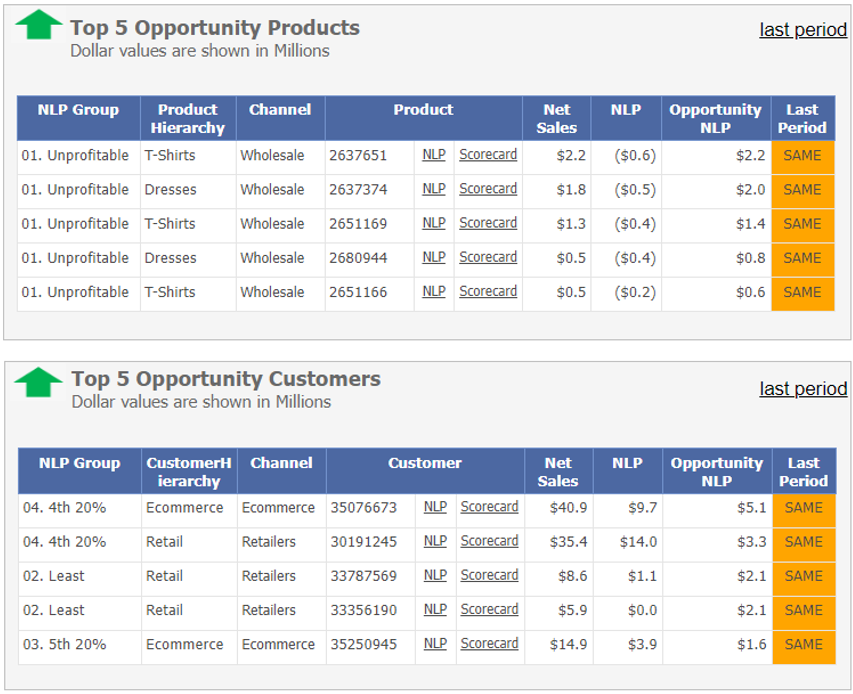

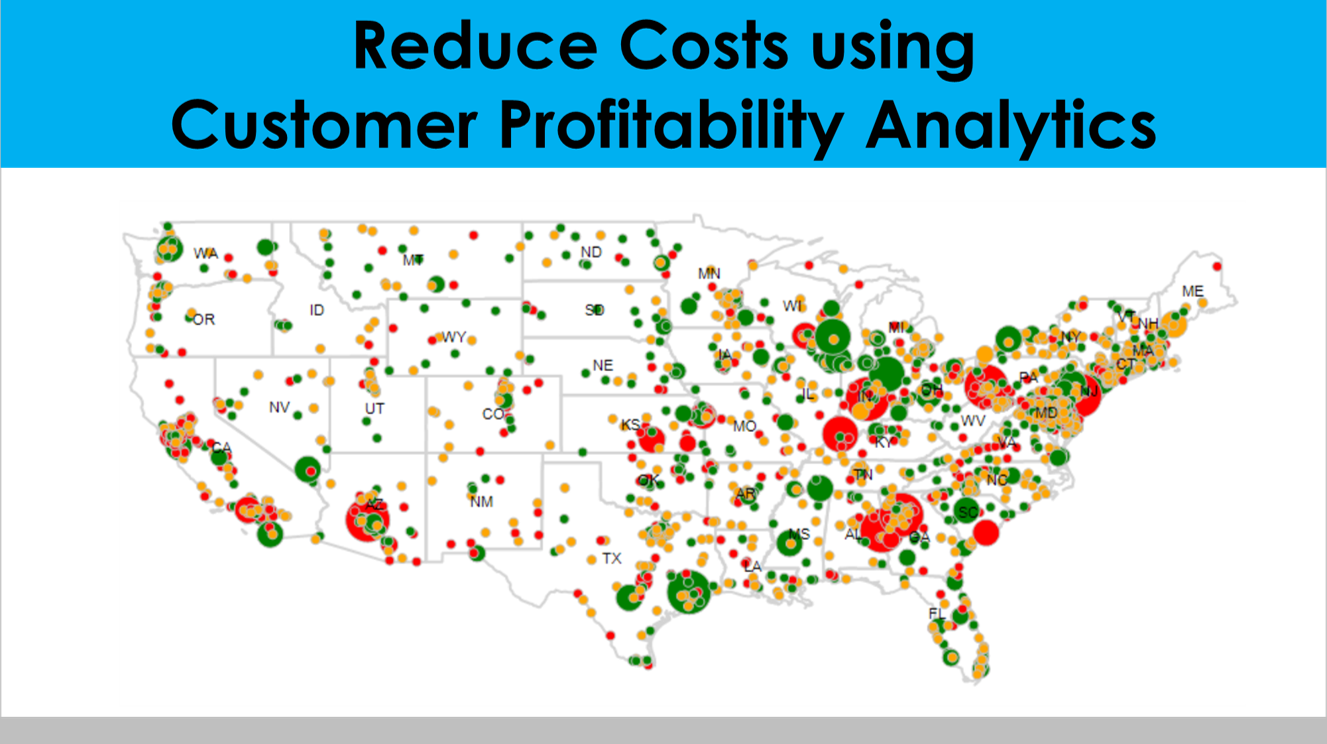

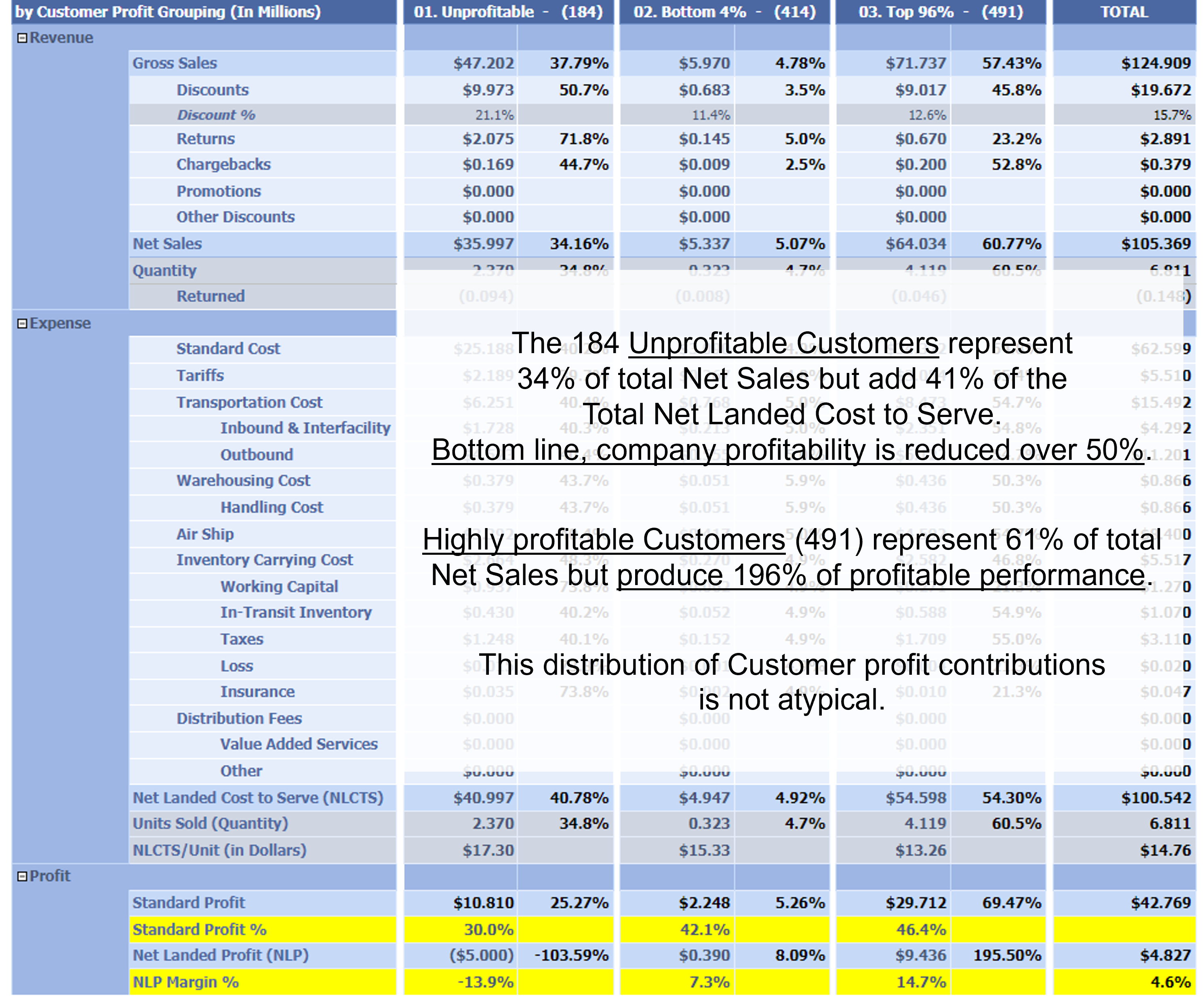

The Executive Vice President for a U.S. based company was dealing with significant cost and complexity pressures. His solution was to focus on the impact of SKU proliferation; "can we measure the specific cost and profit performance at the SKU, Customer, Channel and Region levels to reprioritize resources?”

Working with Competitive Insights, his organization discovered:

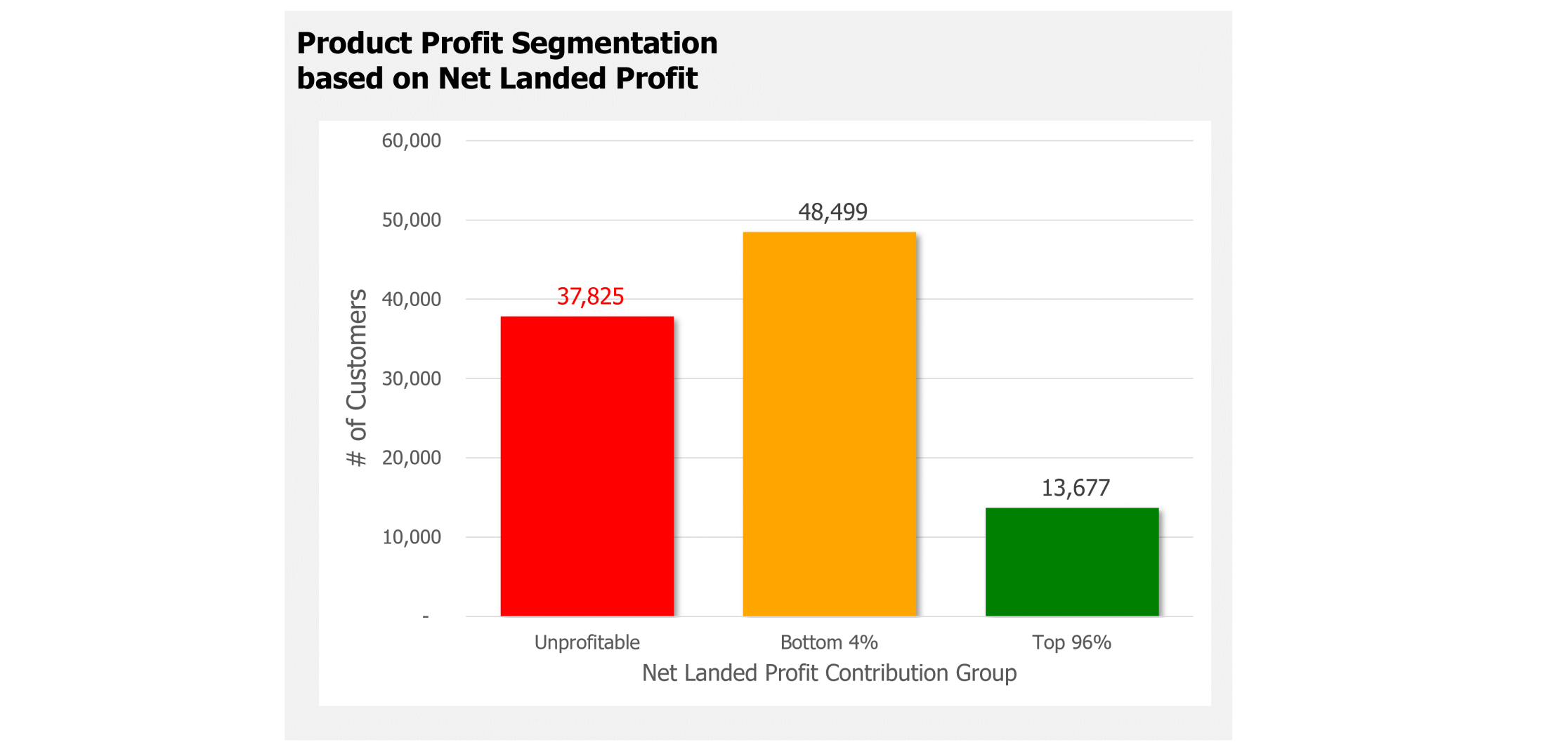

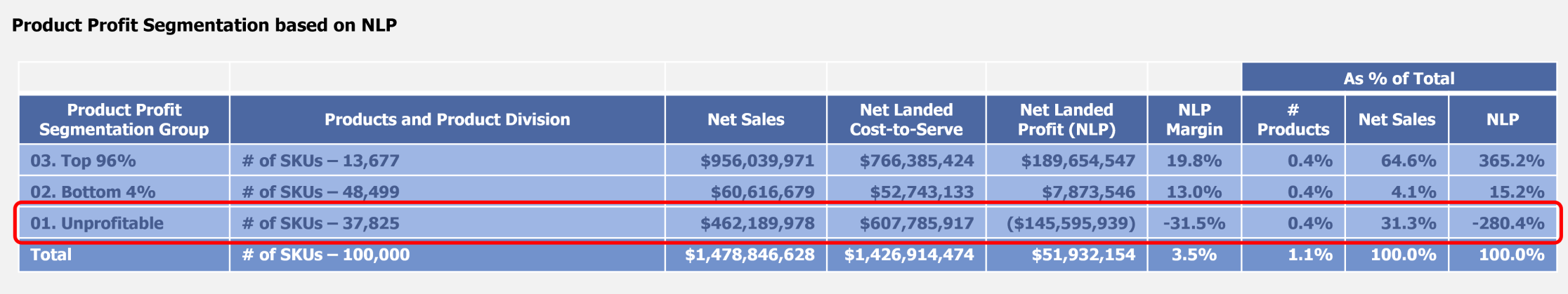

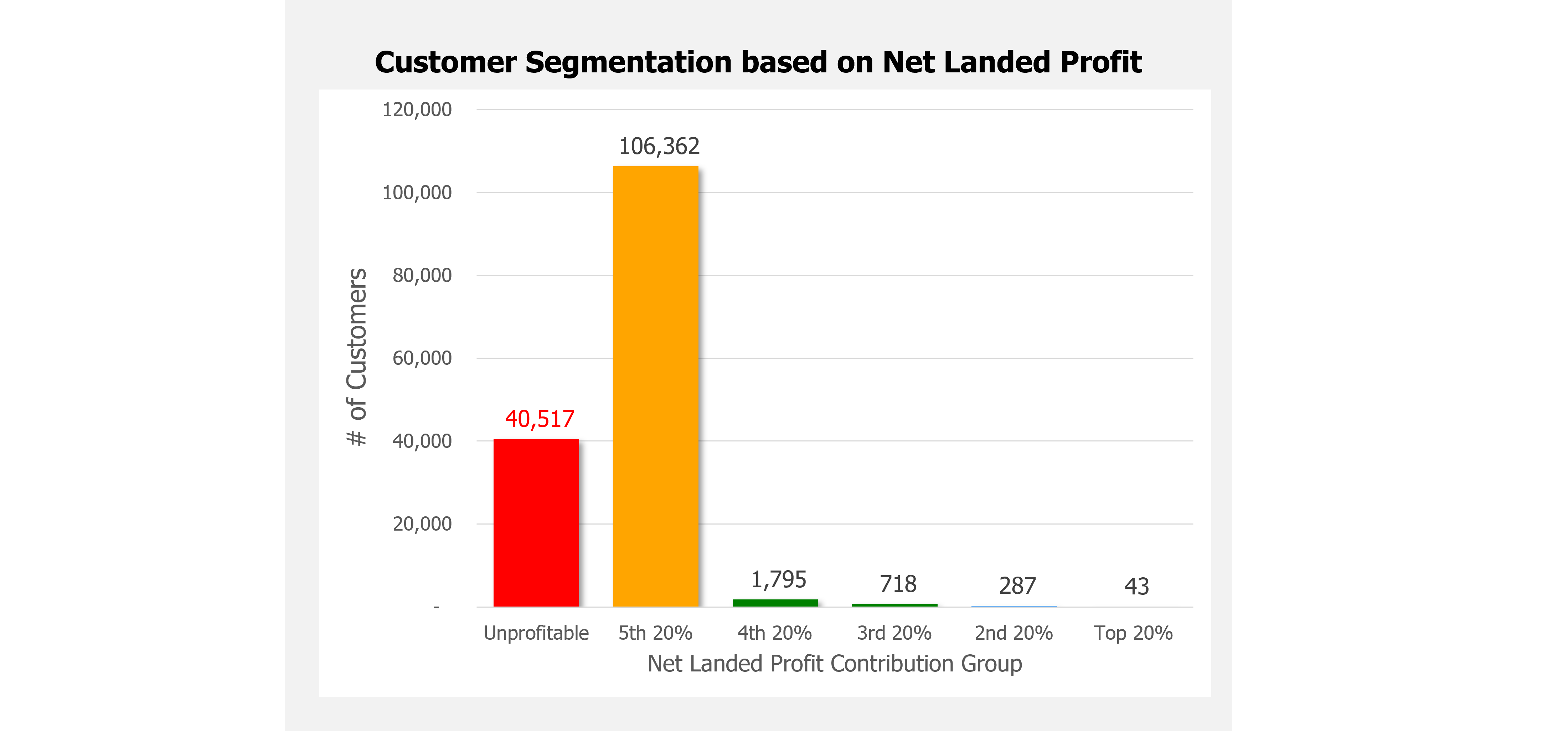

- Only 3% of their entire Customer base was contributing 80% of their profit

- 45% of their operating costs were being spent on servicing unprofitable customers and products

- Their 11th largest Customer, measured by Revenue contributions, was totally unprofitable

Having accurate, specific and trusted Cost and Profit performance insights produces actionable strategies that have extremely positive results.

Please comment on this posting or email me at [email protected]

All the best,

Richard Sharpe

CEO – Competitive Insights

CEO – Competitive Insights