Stuck in the Supply Chain “Fire Fighting” Mode. STOP doing the same things harder and longer! There is a better way!

“Get the right product, to the right customer, at the right time, at the lowest cost”

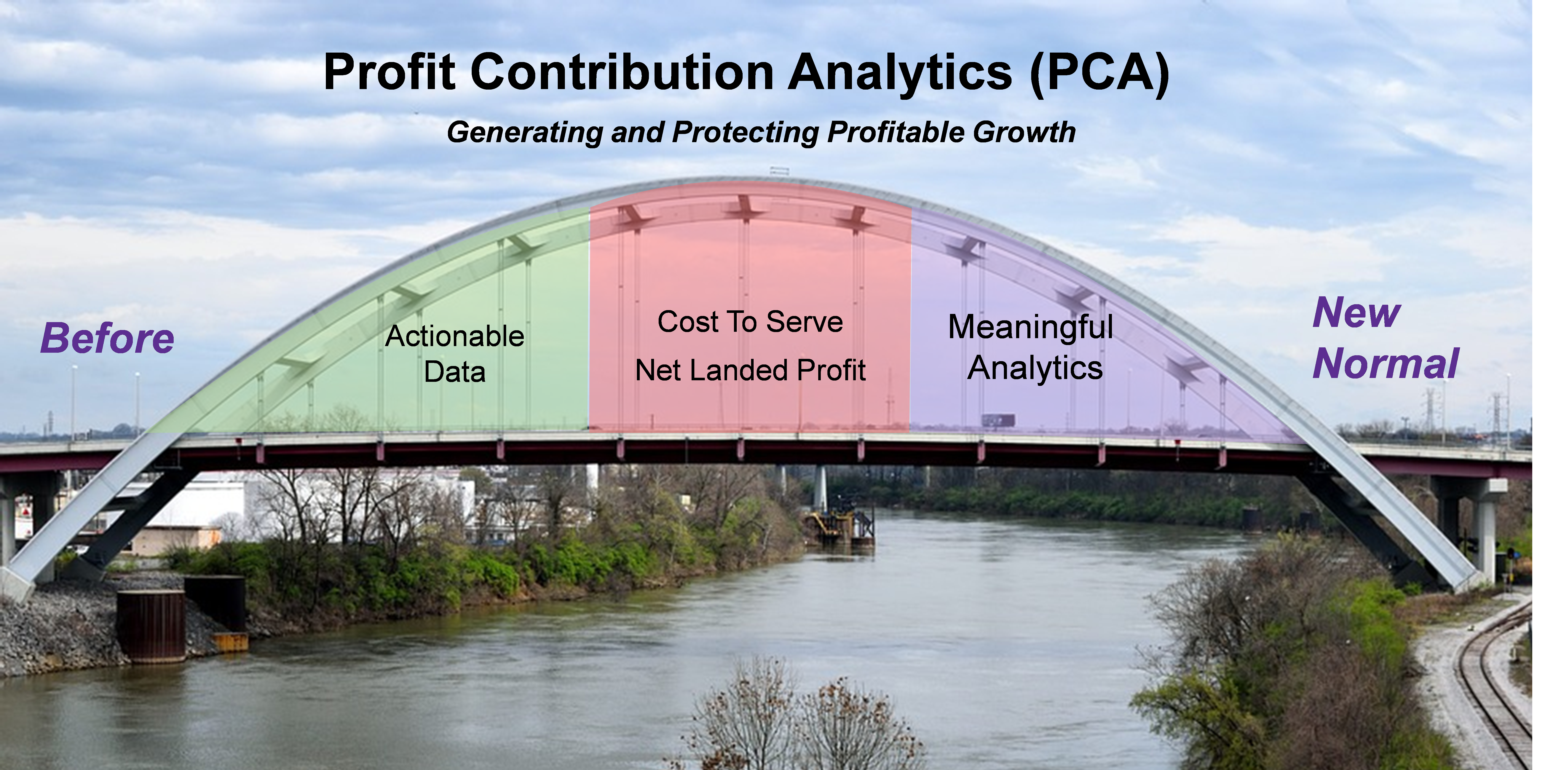

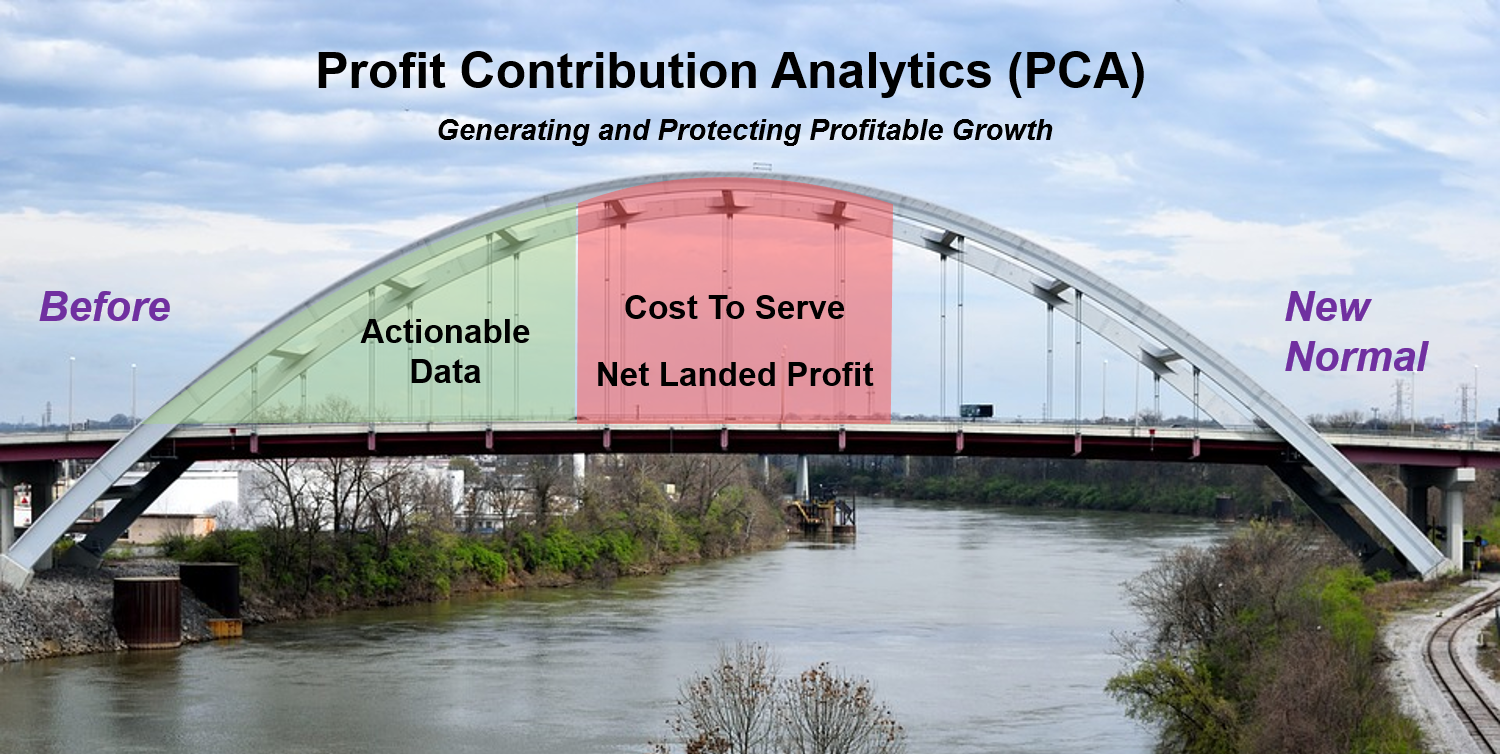

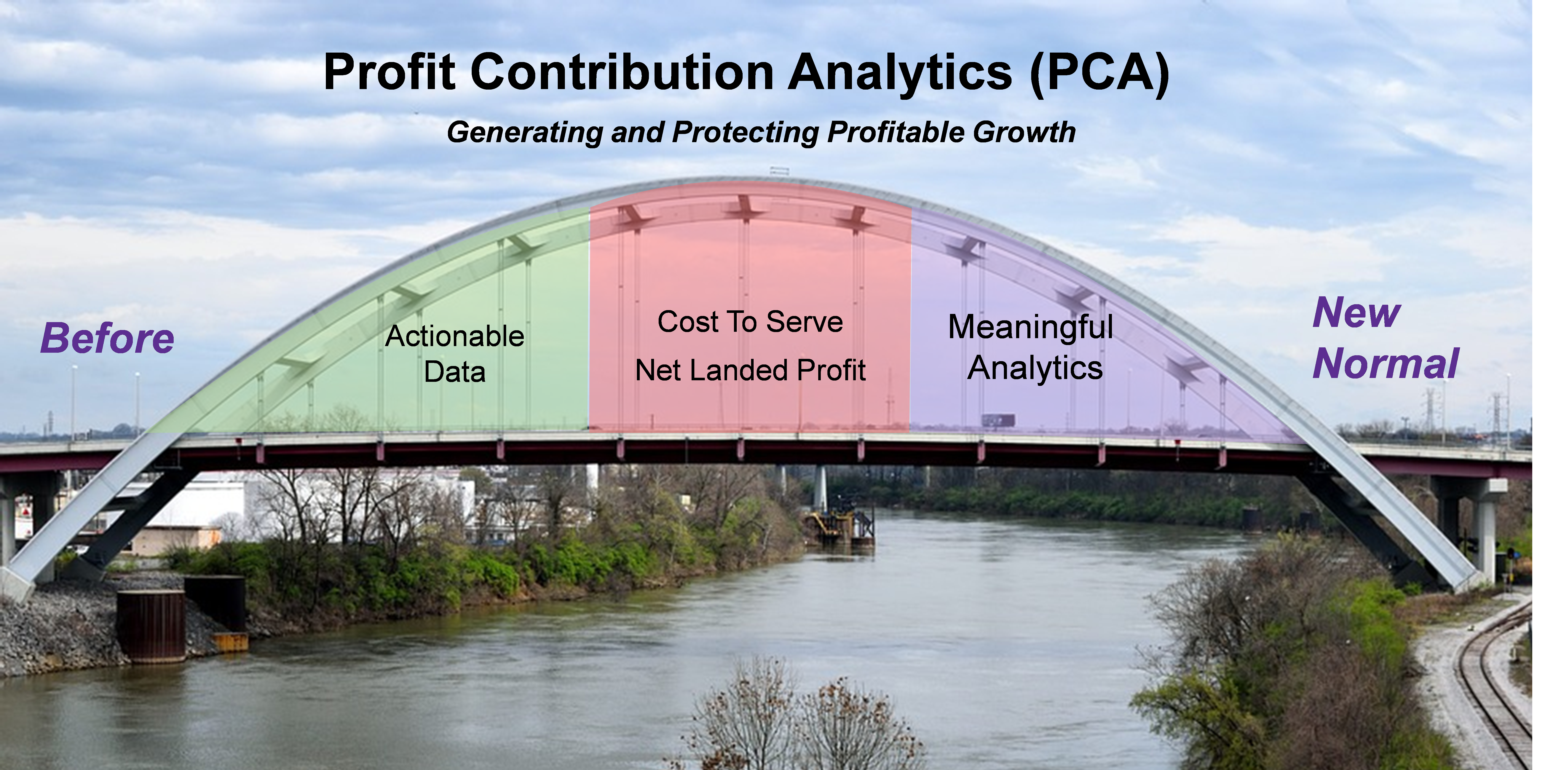

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

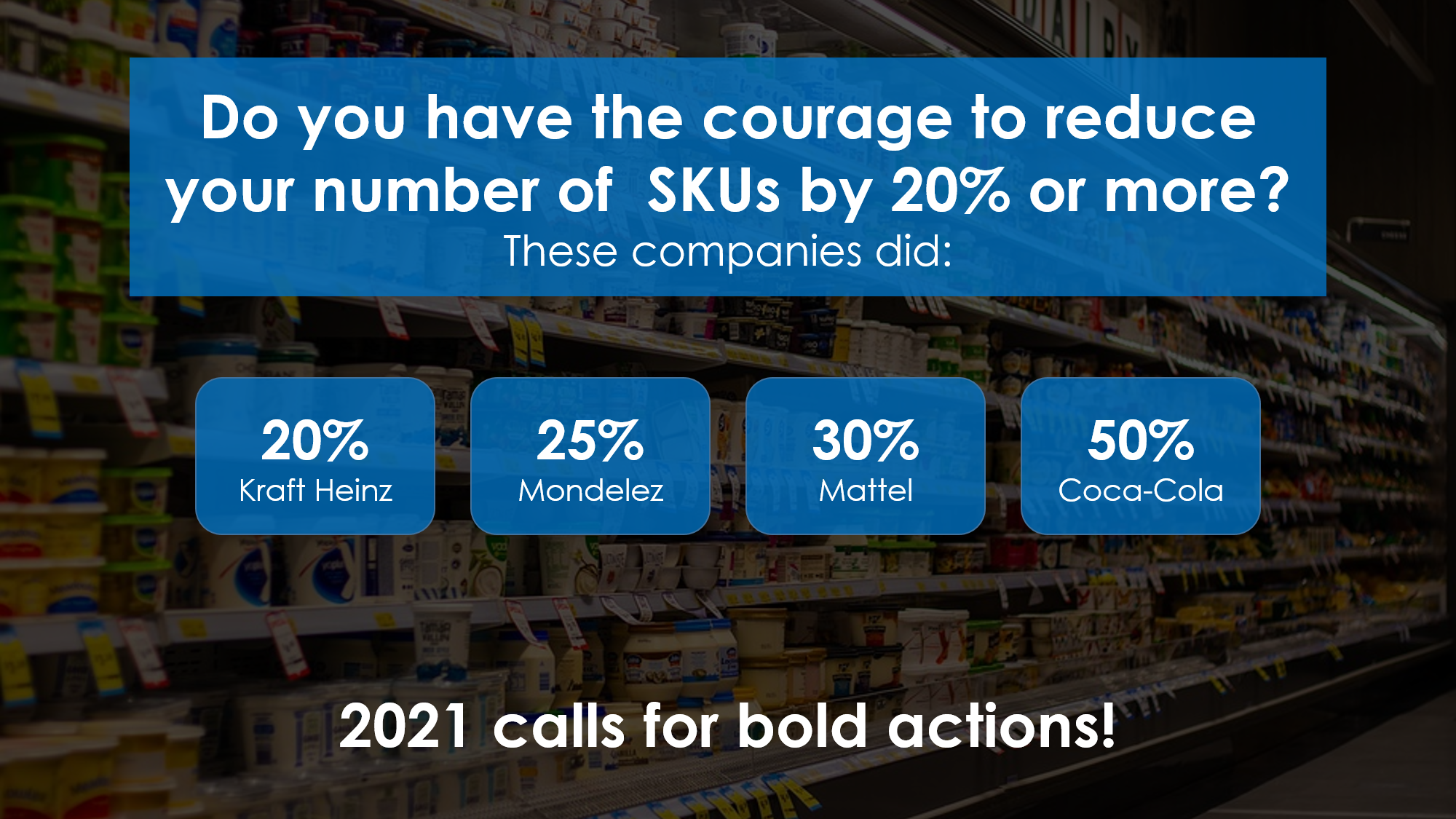

In May, Mattel CEO Ynon Kreiz reported the company reached a 30% SKU reduction eight months ahead of schedule — contributing to a $92 million cost reduction program

"This is an important achievement that will allow us to improve the match between demand and supply, optimize manufacturing decisions, improve customer fill rates and capture additional revenue opportunities," he said.

It's that population of laggards that are now just waking up and saying, 'Oh my gosh, I gotta do something or I'm not going to survive.'

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a founding officer of the American Logistics Aid Network(ALAN) and designated by DC Velocityas a Rainmaker in the industry. For the last 25 years, Richard has been passionate about driving business value through the adoption of process and technology innovations. His current focus is to support CI’s mission to enable companies to gain maximum value through specific, precise and actionable insights across the organization for smarter growth. CI delivers Enterprise Profit Insights (EPI) solutions that enable cross-functional users to increase and protect profitability. Prior to his current role, Richard was President of CAPS Logistics, the forerunner of supply chain optimization. Richard is a frequent speaker at national conferences and leading academic institutions. His current focus is to challenge executives to improve their company’s competitive position by turning enterprise wide data from a liability to an asset through the use of applied business analytics.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a founding officer of the American Logistics Aid Network(ALAN) and designated by DC Velocityas a Rainmaker in the industry. For the last 25 years, Richard has been passionate about driving business value through the adoption of process and technology innovations. His current focus is to support CI’s mission to enable companies to gain maximum value through specific, precise and actionable insights across the organization for smarter growth. CI delivers Enterprise Profit Insights (EPI) solutions that enable cross-functional users to increase and protect profitability. Prior to his current role, Richard was President of CAPS Logistics, the forerunner of supply chain optimization. Richard is a frequent speaker at national conferences and leading academic institutions. His current focus is to challenge executives to improve their company’s competitive position by turning enterprise wide data from a liability to an asset through the use of applied business analytics.

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a founding officer of the American Logistics Aid Network(ALAN) and designated by DC Velocityas a Rainmaker in the industry. For the last 25 years, Richard has been passionate about driving business value through the adoption of process and technology innovations. His current focus is to support CI’s mission to enable companies to gain maximum value through specific, precise and actionable insights across the organization for smarter growth. CI delivers Enterprise Profit Insights (EPI) solutions that enable cross-functional users to increase and protect profitability. Prior to his current role, Richard was President of CAPS Logistics, the forerunner of supply chain optimization. Richard is a frequent speaker at national conferences and leading academic institutions. His current focus is to challenge executives to improve their company’s competitive position by turning enterprise wide data from a liability to an asset through the use of applied business analytics.