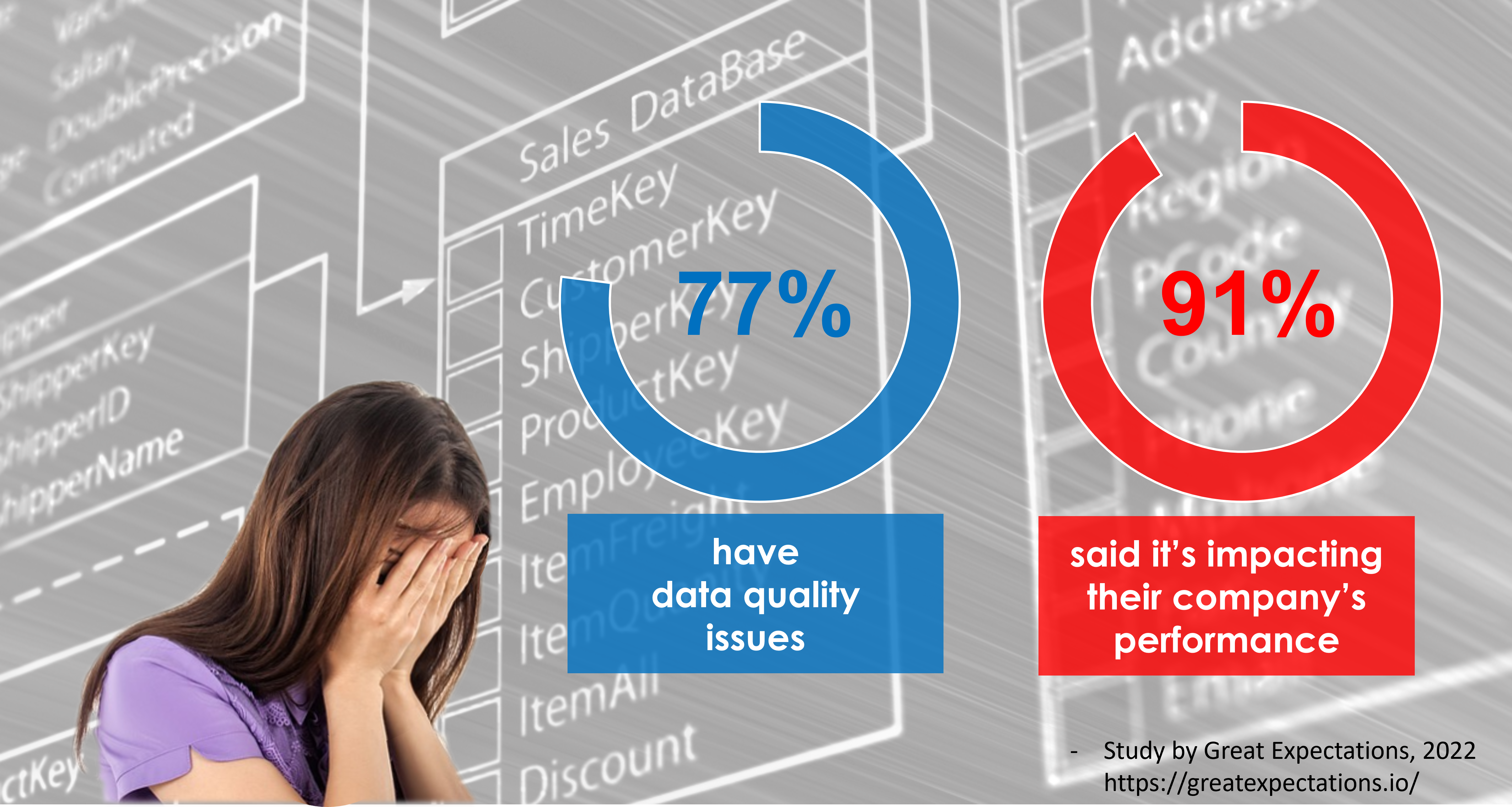

“Our data has significant challenges, and this is a real handicap for us!”

Summary: It is rare to talk to a company that believes they have very little challenges with their data. Unfortunately, many companies use their data integrity issues as a crutch to justify why they are not getting true value from business analytics.

Case In Point: Recently, Competitive Insights (CI) facilitated a meeting with the CFO, COO and SVP of Supply Chain for a well-known apparel company. The Executives knew that to proactively address inflationary pressures to reduce costs and complexity, they needed accurate and specific Cost-to-Serve and Profit Performance insights by Product, Customer and Channel but were skeptical because of concerns about the current state of their data.

Action: Fortunately, the SVP of Supply Chain convinced the other Executives to take a first step that would demonstrate that their data could be turned from a liability to an asset and produce meaningful financial insights to reduce costs and increase profit margins. He emphasized the need to efficiently:

- Obtain, validate and transform all relevant end-to-end transactional data

- Ensure cross-functional buy-in to the Cost-to-Serve and Profit performance insights

- Provide for monthly updates accessible in an easy and intuitive format

Problems are solved by business leaders and managers making decisions that positively impact the efficiency and financial impact of the operation. Decisions that are fact based and that are actionable.

Results: Working with CI, all relevant transactional data was identified. Consensus was reached on how the data should be intentionally validated and transformed to build accurate and specific Product (SKU) and Customer Cost to Serve and Profit information that was far more granular than provided by their P&L. The following actionable financial opportunities were identified:

- Out of 142,493 Products using 875 Colors, only 53 colors provided 80% of their profits

- Segmenting Products and Customers by financial performance revealed that a very small number of Products and Customers contributed 96% of their true operating margin

- Significant opportunities were identified to reduce operating costs by focusing on the large number of Unprofitable and Marginal Customers buying unprofitable Products

- Inventory Working Capital reduction opportunities in excess of $10 million dollars were identified