Strategic Portfolio Decisions – Tackling 2021

Summary

2020 was a year of extremes, from seeing five-years of Business to Consumer growth projections being realized in months to the devastating reduction in Food Service and Restaurant revenues and employment.

2020 was also the catalyst for innovation including the evaluation of portfolio strategies to focus on the products that will drive strategic growth. Here is a synopsis from the Wall Street Journal:

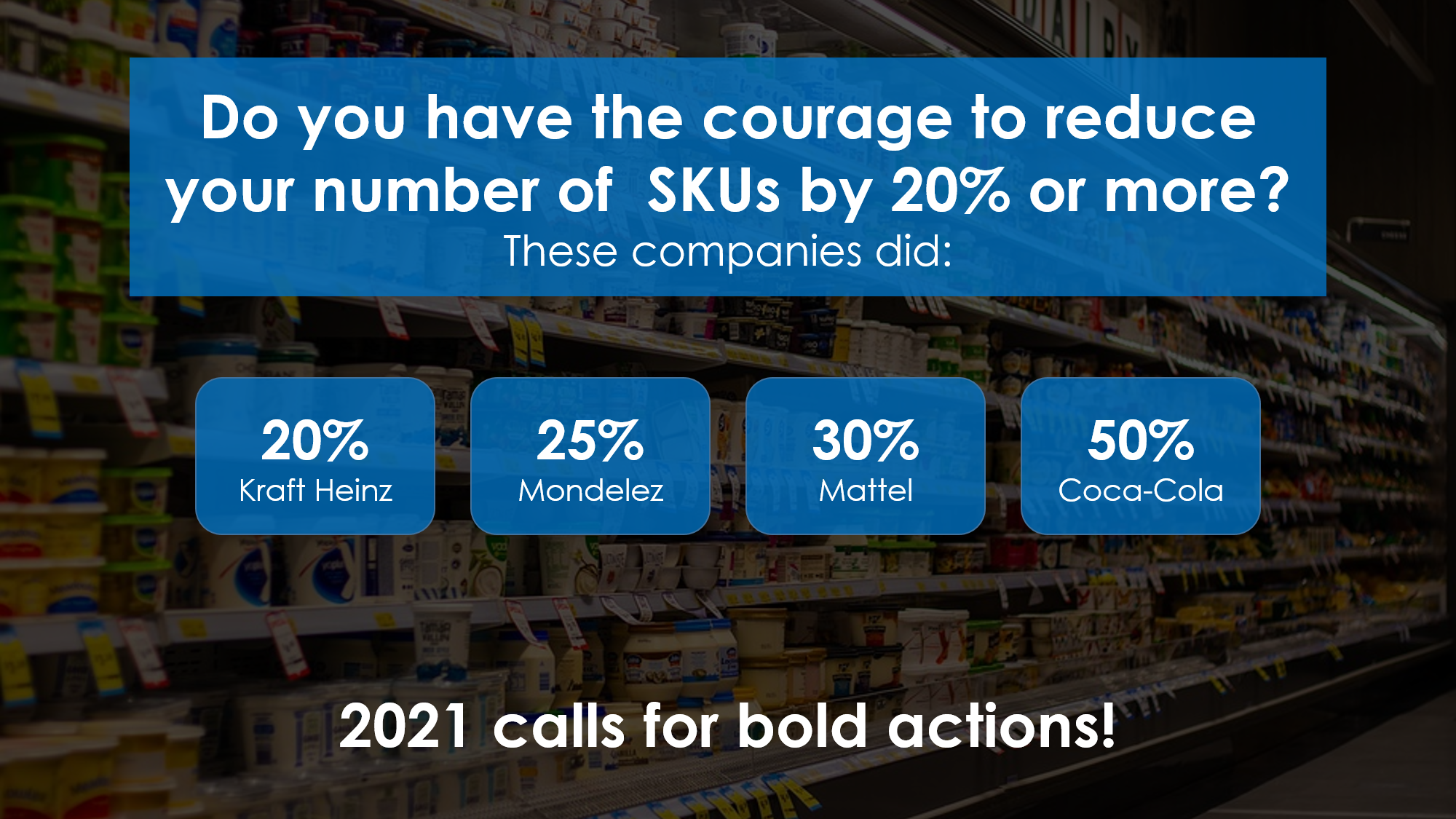

In May, Mattel CEO Ynon Kreiz reported the company reached a 30% SKU reduction eight months ahead of schedule — contributing to a $92 million cost reduction program

"This is an important achievement that will allow us to improve the match between demand and supply, optimize manufacturing decisions, improve customer fill rates and capture additional revenue opportunities," he said.

Benefits

Companies are strategically focusing on products that will produce outsized gains in market share, revenue and profitability. Strategies that are focused on providing clarity for the prioritization of cross-functional activities while significantly reducing complexity and operating costs.

The goal for all companies during the early stages of the pandemic was survival. However, many companies began to plan beyond the next few months by recognizing that “the long end of the profit offering tail” was adding unnecessary complexity and consuming operational capacities. Others are just now beginning to recognize that need. Here is a quote from Peter Bolstorff - EVP, Association for Supply Chain Management:

It's that population of laggards that are now just waking up and saying, 'Oh my gosh, I gotta do something or I'm not going to survive.'

Decision Criteria

So how are companies making these portfolio decisions?

Clearly considerations have to include sales volumes, brand considerations market share, forecasted demand, resource requirements and competitor analysis. However, industry leaders are incorporating one additional critical in the pursuit of strategic growth; the specific cost to serve profit performance for each product in the portfolio.

Doing this in-depth evaluation on an entire portfolio can be an expensive and time consuming for those without experience in building these solutions. Advances in expertise and technology have significantly reduced the time and resources to implement this effort.

Here is an example. A profitable CPG company had historically sold over a 100,000 SKUs through three different channels. Wanting to improve their portfolio performance, they needed to understand what products were great performers and which ones were marginal or unprofitable. Analyzing billions of transactions using 15 months of data, they found that 7,000 products were generating 80% of their entire profitable performance.

Think of the complexity of the supply chain to support delivering 93,000 products and only getting 20% of your profit (marginal products). Using profit analytics, how many products should be dropped, how much cost could be eliminated? Ask Coca-Cola who dropped 50% of their product lines to eliminate 1% of their profit. source

Conclusion

2020 was a challenging year that served as a catalyst for innovation and reflection. It was a year that drastically challenged the ability to meet channel requirements and buyer expectations. It also served as a wakeup call that an ever-growing expansion of product offerings does not necessarily meet the strategic growth requirements for a company and it’s shareholders.

Informed profit based portfolio decisions are part of the new post-pandemic operating model. Are you ready?

Please comment on this posting or email me at [email protected] .

All the best,

Richard Sharpe

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a profit contribution analytics firm that specializes in helping clients efficiently and continuously transform multiple sources of data into actionable operational insights.