Does your “Data Tank” Have Water In It?

It is hard to pick up any industry publication and not see articles on “the digitization of the supply chain” or “the value of supply chain visibility”, or “the power of analytics”. Certainly, the value of these types of supply chain advancements is significant. As certain, some companies will realize the value and thrive while others will not.

Is your operation ready to fully empower and utilize these advancements to get all of the true benefits that analytics can offer? Realized benefits that come from fact based, data driven decisions. Does your data have the high octane impact of TRUSTED data that you really need to run your business?

The Problem

Consider the impact on your business. Do data issues cause your organization to:

- Be hampered by indecisive actions or bad decisions

- Spend valuable time resolving data issues rather than solving problems

- Experience organizational confusion and frustration

- Have a lack of confidence and mistrust about specific functional data

- Believe that data is more of a liability than an asset

You’re not alone. Data quality is a universal issue. A recent Harvard Business Review(https://hbr.org/2016/09/bad-data-costs-the-u-s-3-trillion-per-year) article states that data issues are costing businesses in excess of $3 trillion dollars a year in the U.S. alone! Here is a highlight from the article:

“The reason bad data costs so much is that decision makers, managers, knowledge workers, data scientists, and others must accommodate it in their everyday work. And doing so is both time-consuming and expensive. The data they need has plenty of errors, and in the face of a critical deadline, many individuals simply make corrections themselves to complete the task at hand.”

So what’s the impact of making less than optimal decisions because of imprecise, inaccurate, or untimely data for your company?

The Solution

Here are vital best practices to consider:

- Create Executive Support – data issues create recurring and significant costs and are a real competitive risk. Quantify and qualify this impact to gain a C Level call to action.

- Be Intentional – don’t try to “boil the ocean”. Focus on a critical business priority and demonstrate the value that having validated and trusted data has in the speed of the priority’s success.

- Recognize The Power Of Cross-Functional Consensus – most decisions have a cross-functional impact. Involve other functions in the process to secure early buy-in to the solutions.

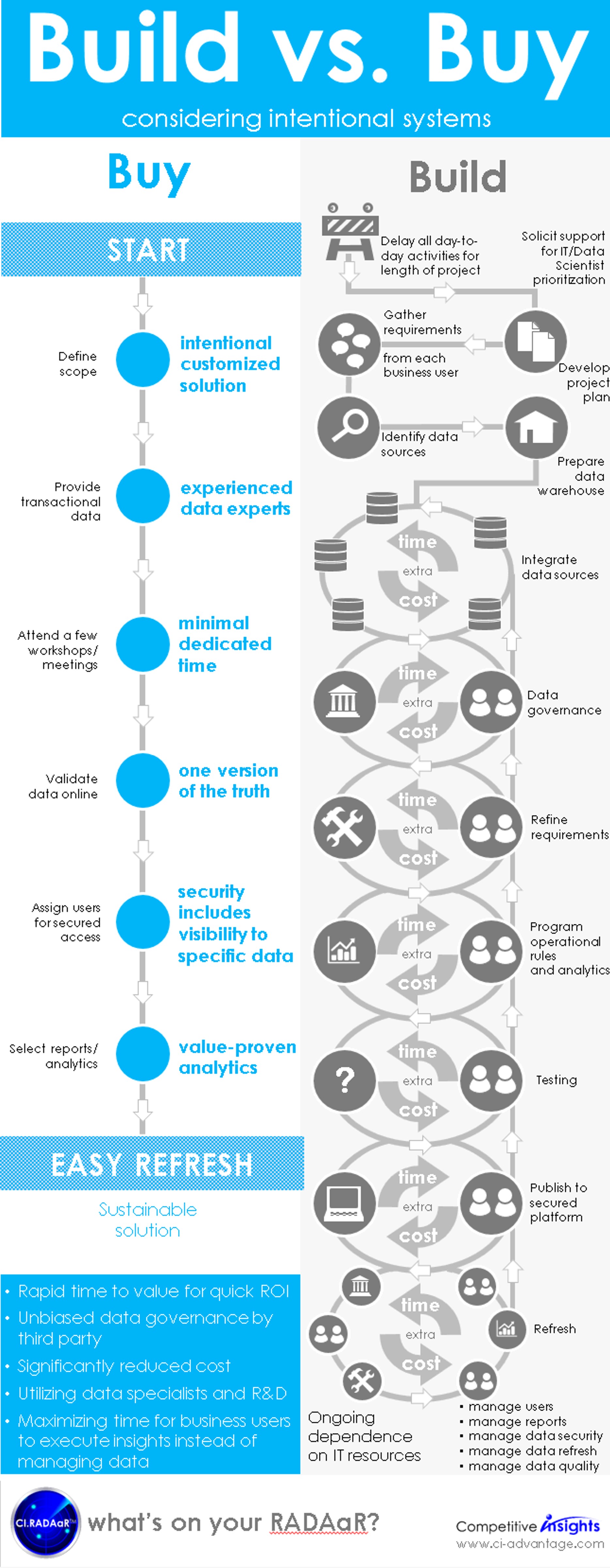

- Apply Proven Methodologies and Technologies – don’t go after this by creating the solution from scratch. There are proven solutions to this problem that are timely, effective and repeatable.

- Approach The Solution As Building Organizational Capability Not As A Project – operating system changes, acquisitions, changes in personnel are just a very few real world reasons that data issues are not a static set of problems. Solve your data issues by investing and building organizational capability to proactively address them over time.

More precise data leads to more precise information and ultimately superior knowledge. The wisest business person will make the worst decisions if they lack trusted, detail data.

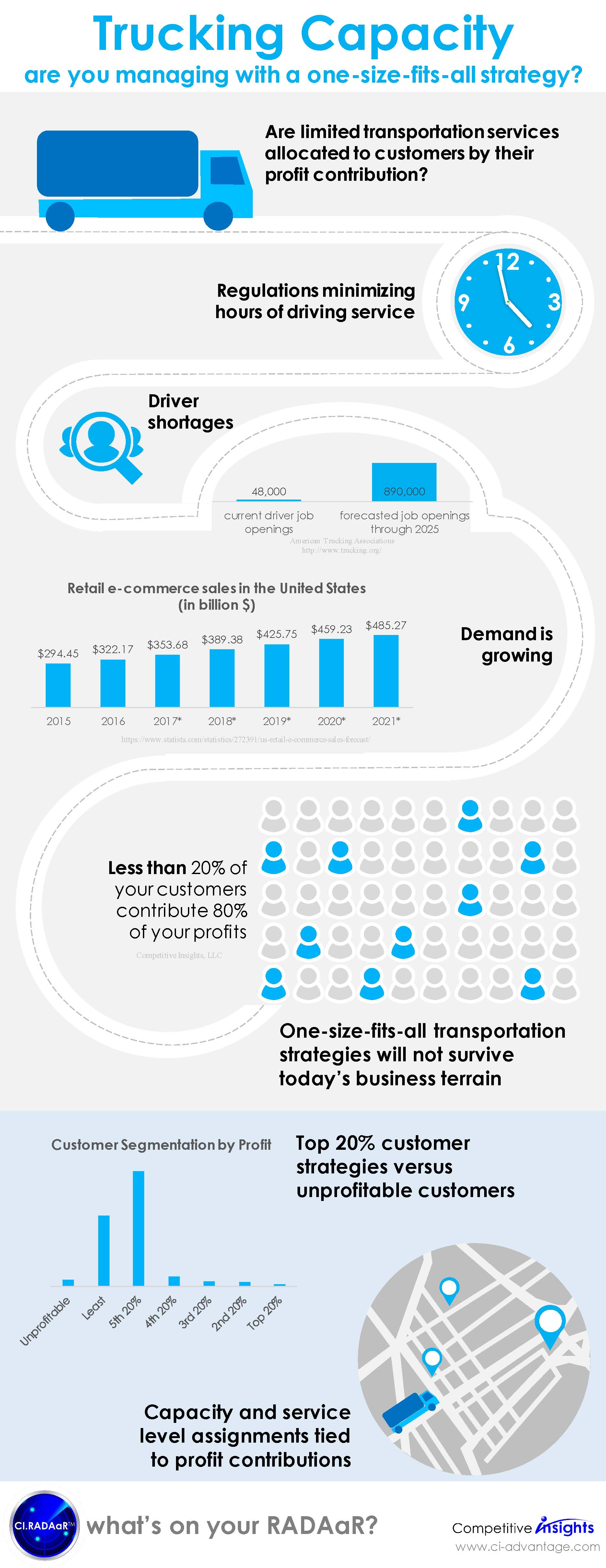

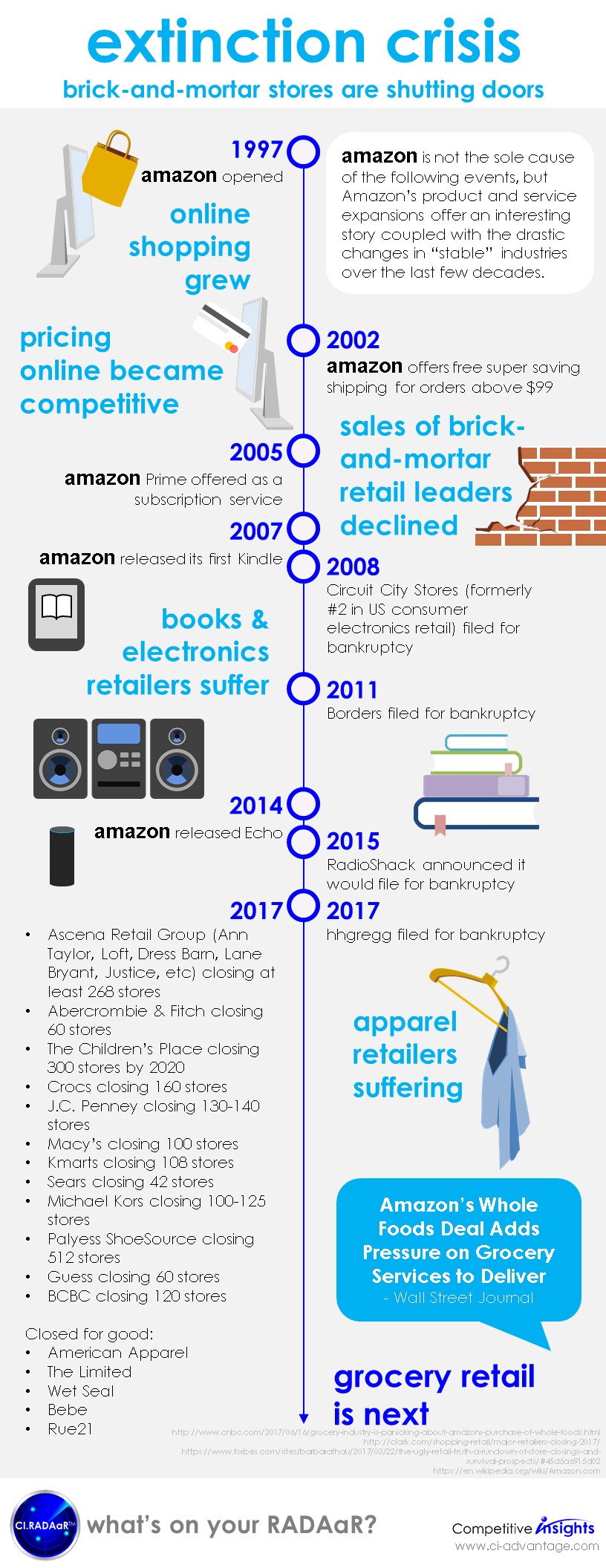

There is more at stake than you might think. Companies that tackle their data issues and empower their decision makers with solid analytical capabilities will continue to win the competitive battle. Those that defer will disappear. Think Amazon!

Need ‘war stories’ and additional information to lead your company to better decisions through better data? Contact Tami Kitajima at tkitjima@ci-advantage.com and we will be happy to provide that information.

All the best,

Richard Sharpe

Richard Sharpe is CEO of Competitive Insights, LLC (CI), a founding officer of the American Logistics Aid Network(ALAN) and designated by DC Velocityas a Rainmaker in the industry. For the last 25 years, Richard has been passionate about driving business value through the adoption of process and technology innovations. His current focus is to support CI’s mission to enable companies to gain maximum value through specific, precise and actionable insights across the organization for smarter growth. CI delivers Enterprise Profit Insights (EPI) solutions that enable cross-functional users to increase and protect profitability. Prior to his current role, Richard was President of CAPS Logistics, the forerunner of supply chain optimization. Richard is a frequent speaker at national conferences and leading academic institutions. His current focus is to challenge executives to improve their company’s competitive position by turning enterprise wide data from a liability to an asset through the use of applied business analytics.